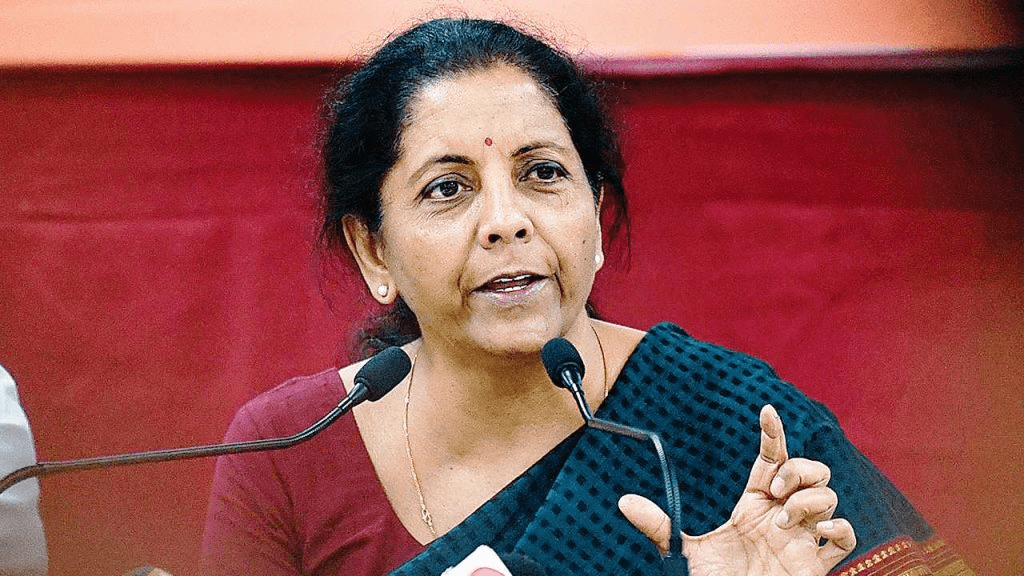

Key points about Finance Minister Nirmala Sitharaman’s announcement about the Unified Pension Scheme (UPS):

- Introduction of UPS: Finance Minister Nirmala Sitharaman introduced the Unified Pension Scheme (UPS) as a new initiative aimed at enhancing the existing National Pension System (NPS).

- Not a Rollback: Sitharaman clarified that UPS is not a rollback of the NPS or the Old Pension Scheme (OPS), but a new package designed to help government employees.

- Government Employees: The scheme is specifically targeted at central government employees who are now subscribers of the NPS.

- Guaranteed Pension: UPS guarantees employees 50% of their average basic pay over the last 12 months before retirement as a pension, provided they have a basic qualifying service of 25 years.

- Proportionate Pension: For employees with a service period of less than 25 years but at least 10 years, the pension will be proportionate.

- Minimum Pension: The scheme assures a minimum payout of ₹10,000 per month on superannuation after a baseline of 10 years of service.

- Flexibility and Choice: Sitharaman emphasized that the scheme offers flexibility and choice, aligning with the government’s approach to governance.

- No Additional Burden: The scheme is designed to help employees without imposing an additional financial burden on the government.

- Opposition’s Claims: The Finance Minister countered claims by the opposition that the scheme shows a U-turn, asserting that it is an improvement rather than a rollback.

- Adoption by States: Sitharaman expressed hope that most states would adopt the UPS due to its many benefits for employees.

-

PM Kisan 22nd Installment Date 2026: Expected Release, Beneficiary Status & Complete Guide

Crores of farmers are waiting — but will the PM Kisan 22nd installment actually reach YOUR account? The

-

Livspace Fires 1,000 Employees and Cofounder Quits: Inside India’s Most Shocking Startup Shakeup of 2026

Livspace called it an “AI pivot.” But the funding drought lasted 4 years. 1,000 employees lost jobs. The

-

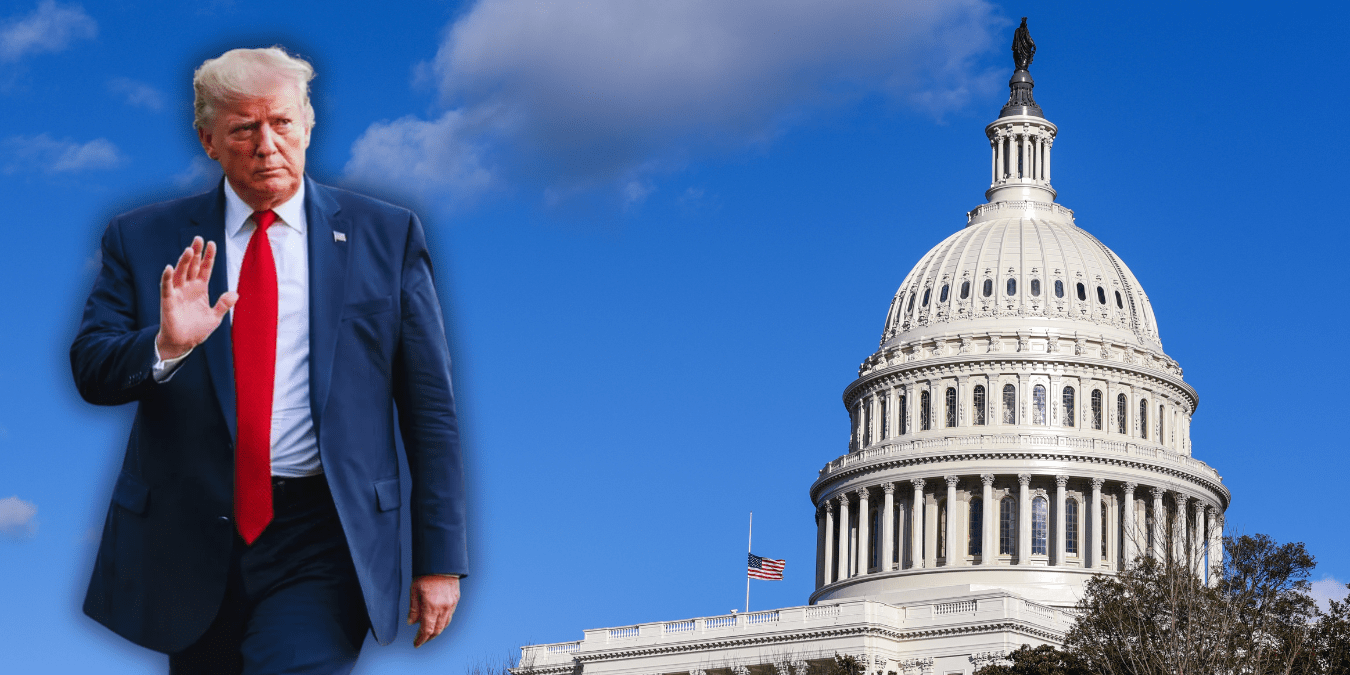

US Supreme Court Strikes Down Trump’s Global Tariffs as ‘Unlawful’ — The 18% Tariff on India Is Now Illegal

The highest court in the United States just delivered one of the most consequential trade rulings in modern

-

Why Gold Prices Hit ₹15,745 per Gram Today: Indian Market Volatility Explained

Gold, silver, copper and platinum prices are seeing sharp moves this week, and Indian investors are closely tracking

-

Spirit Airlines Bankruptcy and Flight Cancellations — The Real Reason!

Spirit Airlines just canceled hundreds of flights across 15+ US airports — and the list keeps growing. Fort

-

Gold and silver rates today: Latest Rates in all Major Cities February 20, 2026

Gold prices exploding ₹15,649/g? Silver crashes 23%—now rebounding at ₹270/g! Uncover shocking volatility secrets, city tables (Delhi to