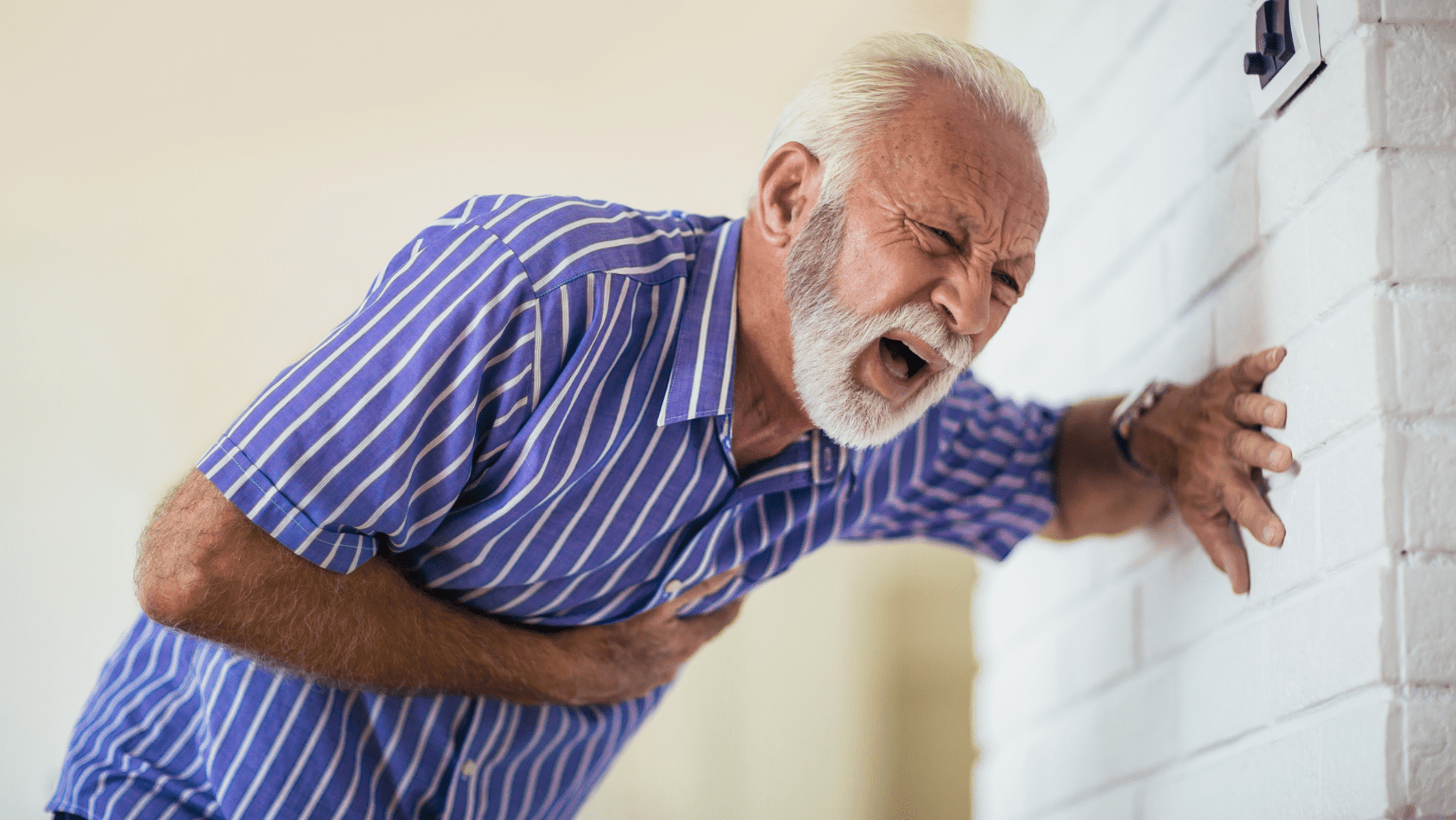

Heart disease is one of the leading causes of death globally, and managing its treatment can be financially draining. Health insurance is a crucial safety net that helps cover the costs associated with heart disease treatment. However, there are instances where health insurance claims related to heart disease are rejected. Understanding the reasons behind these rejections can help you avoid common pitfalls and ensure that your claim is approved.

” The common reasons why your health insurance claim related to heart disease might be rejected and learn actionable tips to ensure your claim is approved. Protect your health and finances with this comprehensive guide. “

In this comprehensive guide, we will explore the various reasons why your health insurance claim related to heart disease might be rejected. We will also provide actionable tips to help you navigate the complexities of health insurance claims and ensure that you receive the coverage you deserve.

Understanding Heart Disease and Health Insurance

Heart disease encompasses a range of conditions that affect the heart, including coronary artery disease, heart attacks, arrhythmias, and heart failure. The treatment for these conditions can be expensive, involving hospitalization, surgeries, medications, and ongoing care.

Health insurance is designed to provide financial protection against these high medical costs. However, the process of filing a health insurance claim can be complex, and there are several factors that can lead to the rejection of your claim.

Common Reasons for Health Insurance Claim Rejection

- Pre-existing Conditions

One of the most common reasons for claim rejection is the presence of pre-existing conditions. If you were diagnosed with heart disease before purchasing the health insurance policy, the insurer may consider it a pre-existing condition. Most policies have a waiting period for pre-existing conditions, ranging from 1 to 4 years. If you file a claim during this waiting period, it is likely to be rejected.

Tip: Always check the waiting period for pre-existing conditions when purchasing a health insurance policy. If you have a pre-existing condition, consider policies with shorter waiting periods or specialized plans for heart disease.

- Waiting Period

Even if you don’t have a pre-existing condition, most health insurance policies have a waiting period for specific treatments, including those related to heart disease. This waiting period can range from 30 days to 2 years. If you file a claim during this period, it may be rejected.

Tip: Be aware of the waiting periods specified in your policy and plan your treatments accordingly. If you need immediate treatment, consider policies with shorter waiting periods.

- Non-Disclosure of Medical History

When applying for health insurance, it is crucial to disclose your complete medical history. Failure to disclose pre-existing conditions, past treatments, or any other relevant medical information can lead to claim rejection. Insurers may view non-disclosure as an attempt to hide information, which can result in the denial of your claim.

Tip: Always provide accurate and complete information when applying for health insurance. If you are unsure about any aspect of your medical history, consult your doctor or medical records.

- Incorrect Information

Providing incorrect information on your insurance application, such as your age, weight, or lifestyle habits (e.g., smoking or alcohol consumption), can lead to claim rejection. Insurers use this information to assess your risk profile and determine your premium. If the information provided is found to be inaccurate, your claim may be denied.

Tip: Double-check all the information you provide on your insurance application to ensure its accuracy. If you make a mistake, inform your insurer immediately to correct it.

- Policy Exclusions

Every health insurance policy has a list of exclusions—conditions or treatments that are not covered. Some policies may exclude certain types of heart disease treatments or specific procedures. If your claim falls under an exclusion, it will be rejected.

Tip: Carefully review the policy exclusions before purchasing health insurance. If you have a specific heart condition, ensure that the policy covers the necessary treatments.

- Lack of Documentation

Insufficient or incomplete documentation is another common reason for claim rejection. Insurers require detailed medical records, bills, and other documents to process your claim. If any required documents are missing or incomplete, your claim may be denied.

Tip: Keep all medical records, bills, and receipts organized and readily available. Ensure that you submit all required documents when filing a claim.

- Treatment at a Non-Network Hospital

Most health insurance policies have a network of hospitals where you can receive cashless treatment. If you receive treatment at a non-network hospital, your claim may be rejected or only partially covered.

Tip: Always check the list of network hospitals provided by your insurer. If possible, choose a network hospital for your treatment to avoid claim rejection.

- Delayed Claim Intimation

Health insurance policies require you to inform the insurer about your hospitalization or treatment within a specified time frame, usually 24 to 48 hours. If you delay in intimating the insurer, your claim may be rejected.

Tip: Notify your insurer as soon as possible after hospitalization or treatment. Keep the insurer’s contact information handy for quick communication.

- Non-Adherence to Policy Terms

Health insurance policies come with specific terms and conditions that you must adhere to. For example, some policies may require pre-authorization for certain treatments or surgeries. If you fail to follow these terms, your claim may be rejected.

Tip: Read and understand the terms and conditions of your policy. Follow all the required procedures, such as pre-authorization, to ensure that your claim is approved.

- Experimental or Alternative Treatments

Health insurance policies typically cover standard, evidence-based treatments for heart disease. If you opt for experimental or alternative treatments that are not recognized by the medical community, your claim may be rejected.

Tip: Stick to standard, evidence-based treatments that are covered by your policy. If you are considering alternative treatments, consult your insurer to determine if they are covered.

How to Avoid Health Insurance Claim Rejection

- Disclose All Medical Information

The most important step in avoiding claim rejection is to disclose all relevant medical information when applying for health insurance. This includes pre-existing conditions, past treatments, and any other health-related information. Honesty is key to ensuring that your claim is approved.

- Understand Your Policy

Before purchasing a health insurance policy, take the time to read and understand the terms and conditions. Pay special attention to the coverage, exclusions, waiting periods, and claim procedures. If you have any questions, don’t hesitate to ask your insurer or a financial advisor.

- Choose the Right Insurance Plan

Not all health insurance plans are created equal. Some plans offer better coverage for heart disease than others. When choosing a plan, consider your specific health needs and select a policy that provides comprehensive coverage for heart disease treatments.

- Keep All Documentation Ready

Proper documentation is essential for a successful health insurance claim. Keep all medical records, bills, receipts, and other relevant documents organized and readily available. This will make it easier to submit a complete claim and avoid delays or rejections.

- Adhere to Policy Terms

Follow all the terms and conditions of your health insurance policy. This includes obtaining pre-authorization for certain treatments, notifying the insurer within the specified time frame, and adhering to the policy’s guidelines for treatment and hospitalization.

- Seek Pre-Authorization

For certain treatments or surgeries, your insurer may require pre-authorization. This means that you need to get approval from the insurer before undergoing the treatment. Failure to obtain pre-authorization can result in claim rejection.

- Stay Within Network Hospitals

Whenever possible, choose a network hospital for your treatment. Network hospitals have agreements with insurers to provide cashless treatment, which can simplify the claims process and reduce the risk of rejection.

- File Claims Promptly

Notify your insurer as soon as possible after hospitalization or treatment. Delayed claim intimation can lead to claim rejection. Keep the insurer’s contact information handy and follow the required procedures for filing a claim.

Heart disease is a serious condition that requires timely and expensive treatment. Health insurance can provide the financial protection you need to manage the costs associated with heart disease. However, it is essential to understand the reasons why your health insurance claim might be rejected and take steps to avoid common pitfalls.

By disclosing all medical information, understanding your policy, choosing the right insurance plan, keeping all documentation ready, adhering to policy terms, seeking pre-authorization, staying within network hospitals, and filing claims promptly, you can increase the chances of your health insurance claim being approved.

Remember, the key to a successful health insurance claim is preparation and knowledge. Take the time to understand your policy and follow the necessary steps to ensure that you receive the coverage you deserve. Your health and financial well-being depend on it.

-

8th Pay Commission Breaking: 5 Promotions, OPS Back, CGHS ₹20K – What Staff Bodies Want Now

th Pay Commission Twist: Govt staff demand 5 career promotions, full OPS revival, and CGHS allowance exploding from

-

Thousands of Widows and Disabled Pensioners Now Eligible for Free Treatment — What Changed Under PM-JAY?

Widows and disability pensioners were silently excluded from PM-JAY for years — and most still don’t know they’re

-

Saudi Arabia Bans Poultry & Egg Imports From 40 Countries — Is India on the List?

Saudi Arabia just banned poultry and egg imports from 40 countries — and India is on the list.