Introduction

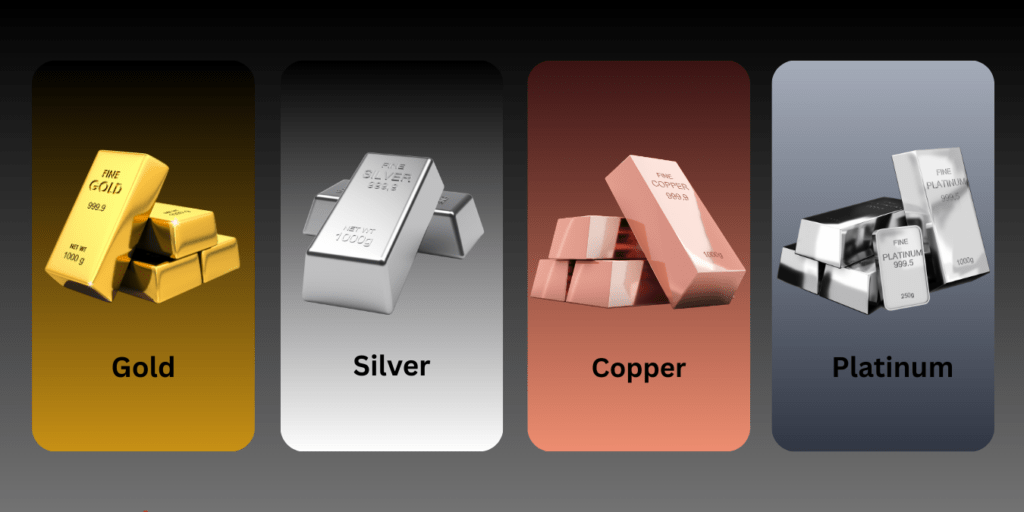

Bandhan Retirement Fund Direct Growth is a mutual fund scheme that aims to provide long-term capital appreciation by investing in a diversified portfolio of equity and equity-related instruments across market capitalization. The scheme also offers tax benefits under Section 80C of the Income Tax Act, 1961, subject to a lock-in period of five years.

The scheme was launched on 18 Oct 2023 and has an NAV of ₹10.00 as of 28 Sep 2023. The scheme has not yet declared any returns since its inception. The expense ratio of the scheme is NA as of 28 Sep 2023. The minimum investment amount for the scheme is ₹1,000 for the first investment and ₹100 for subsequent investments. The minimum SIP amount is ₹100.

The scheme is managed by Bandhan Mutual Fund, which is ranked #9 in India in terms of total assets under management (AUM). The fund house has ₹1,22,101.48Cr worth of AUM as of 30 Jun 2023. The fund house also offers other schemes such as Bandhan Sterling Value Fund Direct Plan-Growth, Bandhan Nifty 50 Index Fund Direct Plan Growth4, and Bandhan Midcap Fund – Direct Plan.

Benefits of Bandhan Retirement Fund Direct Growth

Some of the benefits of Bandhan Retirement Fund Direct Growth are:

- It is a hybrid aggressive fund that invests in a mix of equity, debt, and other instruments across market capitalization. This can help you diversify your portfolio and balance your risk-return trade-off.

- It offers tax benefits under Section 80C of the Income Tax Act, 1961, subject to a lock-in period of five years. This can help you save tax on your income and also encourage long-term investing.

- It is managed by Bandhan Mutual Fund, which is ranked #9 in India in terms of total assets under management (AUM). The fund house has ₹1,22,101.48Cr worth of AUM as of 30 Jun 2023. The fund house also offers other schemes such as Bandhan Sterling Value Fund Direct Plan-Growth, Bandhan Nifty 50 Index Fund Direct Plan Growth, and Bandhan Midcap Fund – Direct Plan.

- It has a low minimum investment amount of ₹1,000 for the first investment and ₹100 for subsequent investments. The minimum SIP amount is ₹100. This can make it affordable and accessible for investors with different budgets and goals.

- It has a simple and convenient online investment process through platforms like Groww, ET Money, ClearTax, or Value Research. You can complete your KYC formalities online and choose the mode of investment (lumpsum or SIP) as per your preference. You can also compare the scheme with other similar funds and check their performance and ratings before investing.

Eligibility Criteria for Bandhan Retirement Fund Direct Growth

The eligibility criteria for Bandhan Retirement Fund Direct Growth are as follows:

- You should be an Indian resident or a non-resident Indian (NRI) or a person of Indian origin (PIO) or a foreign portfolio investor (FPI) registered with SEBI.

- You should be above 18 years of age or a minor through a guardian.

- You should have completed your KYC formalities online and have a valid PAN card.

- You should have a bank account in India with a valid cheque book or debit card or net banking facility.

- You should have a minimum investment amount of ₹1,000 for the first investment and ₹100 for subsequent investments. The minimum SIP amount is ₹100.

Documents Required

The documents required for Bandhan Retirement Fund Direct Growth are as follows:

- A valid PAN card: You need to have a permanent account number (PAN) issued by the Income Tax Department of India to invest in any mutual fund scheme. You also need to complete your KYC (know your customer) formalities online using your PAN card.

- A bank account in India: You need to have a bank account in India with a valid cheque book or debit card or net banking facility to invest in Bandhan Retirement Fund Direct Growth. You also need to provide your bank account details and a cancelled cheque as proof of your bank account.

- A valid address proof: You need to provide a valid address proof such as Aadhaar card, passport, driving license, voter ID card, or utility bill to invest in Bandhan Retirement Fund Direct Growth. You also need to ensure that your address is updated in your KYC records.

- A valid identity proof: You need to provide a valid identity proof such as Aadhaar card, passport, driving license, voter ID card, or PAN card to invest in Bandhan Retirement Fund Direct Growth. You also need to ensure that your name and date of birth are correct in your KYC records.

These are the basic documents required for Bandhan Retirement Fund Direct Growth. However, depending on your mode of investment (lumpsum or SIP), you may also need to provide additional documents such as SIP mandate form, NACH form, or ECS form.

What is the lock-in period for this scheme?

The lock-in period for Bandhan Retirement Fund Direct Growth is five years. This means that you cannot withdraw or switch your investment from this scheme before completing five years from the date of investment. This is a mandatory condition to avail the tax benefits under Section 80C of the Income Tax Act, 1961. If you withdraw or switch your investment before the lock-in period, you will have to pay tax on the capital gains and also forfeit the tax benefits claimed earlier.

How can I redeem my units after the lock-in period?

You can redeem your units after the lock-in period of five years by following any of these methods:

- Directly through AMC: If you have invested in Bandhan Retirement Fund Direct Growth directly with the asset management company (AMC), then you can redeem using their online portal. You can choose to sell some units or all, as per your requirement. You can also redeem units offline by visiting the AMC office.

- Through a trading or Demat account: If you had bought the mutual funds through a Demat account or trading account, then you will have to redeem your units through the same account. Once the process is completed, an electronic payout (NEFT or IMPS) against the redemption request will be made.

- Offline through an agent or distributor: You can also redeem your units offline by submitting a redemption request form at the nearest CAMS office. CAMS is a central service that provides the facility of redeeming mutual funds bought from several AMCs.

Please note that you may have to pay tax on the capital gains and exit load on redeeming your units, depending on the type of fund and the period of holding.

What is the minimum investment amount for this scheme?

The minimum investment amount for Bandhan Retirement Fund Direct Growth is ₹1,000 for the first investment and ₹100 for subsequent investments. The minimum SIP amount is ₹100. You can invest in this scheme online through platforms like Groww, ET Money, ClearTax, or Value Research. You will need to complete your KYC formalities online and choose the mode of investment (lumpsum or SIP) as per your preference.

Expense Ratio

The expense ratio of Bandhan Retirement Fund Direct Growth is NA as of 28 Sep 2023. This means that the fund house has not yet disclosed the annual charges for managing this scheme. The expense ratio is the percentage of the fund’s assets that are deducted every year for fund management, administration, advertising, and other expenses. A lower expense ratio means lower costs for investors and higher returns in the long run.

How risky is Bandhan Retirement Fund Direct Growth?

Bandhan Retirement Fund Direct Growth is a hybrid aggressive fund that invests in a mix of equity, debt, and other instruments. The scheme aims to provide long-term capital appreciation and income for investors who are planning for their retirement. However, like any other investment, this scheme also carries some risks that you should be aware of before investing.

The risk profile of Bandhan Retirement Fund Direct Growth is very high for the equity component, low to moderate for the debt component and very high for the REITs and InvITs component1. This means that the scheme is exposed to various market risks such as interest rate risk, credit risk, liquidity risk, reinvestment risk, concentration risk, and volatility risk. The scheme may also face risks related to changes in government policies, regulations, taxation, and economic conditions that may affect the performance of the underlying securities.

The scheme does not guarantee any returns or assure any protection of capital. The value of your investment may go up or down depending on the market movements and the performance of the fund manager. You may also face redemption risk if you withdraw your investment before the lock-in period of five years. You will have to pay tax on the capital gains and also forfeit the tax benefits claimed earlier.

Therefore, you should invest in Bandhan Retirement Fund Direct Growth only if you have a high risk appetite and a long-term investment horizon. You should also diversify your portfolio with other asset classes and schemes to reduce your overall risk exposure. You should review your investment periodically and make changes if required, based on your goals and risk profile.

Fees and Charges

The fees and charges of Bandhan Retirement Fund Direct Growth are as follows:

- Expense ratio: The expense ratio is the percentage of the fund’s assets that are deducted every year for fund management, administration, advertising, and other expenses. A lower expense ratio means lower costs for investors and higher returns in the long run. The expense ratio of Bandhan Retirement Fund Direct Growth is NA as of 28 Sep 2023. This means that the fund house has not yet disclosed the annual charges for managing this scheme.

- Exit load: The exit load is the charge levied by the fund house when an investor redeems or switches units from a scheme before a specified period. The exit load is usually expressed as a percentage of the redemption value. The exit load of Bandhan Retirement Fund Direct Growth is Nil. This means that there is no charge for redeeming or switching units from this scheme.

- Stamp duty: The stamp duty is a tax levied by the government on the purchase and transfer of mutual fund units. The stamp duty is applicable from 1 July 2020 and is charged at the rate of 0.005% of the transaction value. This means that for every ₹1,00,000 invested in this scheme, ₹5 will be deducted as stamp duty.

- Tax implication: The tax implication is the amount of tax that an investor has to pay on the returns earned from a mutual fund scheme. The tax implication depends on the type of fund, the holding period, and the investor’s tax slab. The tax implication of Bandhan Retirement Fund Direct Growth is NA1. This means that the fund house has not yet specified the tax treatment of this scheme. However, generally, hybrid aggressive funds are taxed as follows:

- Short-term capital gains (STCG): If an investor redeems or switches units from a hybrid aggressive fund before one year, the returns are taxed as STCG at the rate of 15%. This means that for every ₹1,00,000 earned as STCG from this scheme, ₹15,000 will be deducted as tax.

- Long-term capital gains (LTCG): If an investor redeems or switches units from a hybrid aggressive fund after one year, the returns are taxed as LTCG at the rate of 10% on returns exceeding ₹1 lakh in a financial year. This means that for every ₹1,00,000 earned as LTCG from this scheme above ₹1 lakh limit, ₹10,000 will be deducted as tax.

These are the fees and charges of Bandhan Retirement Fund Direct Growth.

Frequently Asked Questions (FAQ)

- What is Bandhan Retirement Fund Direct – Growth?

Bandhan Retirement Fund Direct – Growth is a mutual fund scheme specifically designed to help investors save for their retirement. It is an investment avenue that aims to generate wealth over the long term by investing in a diversified portfolio of stocks, bonds, and other securities.

2. Who is eligible to invest in Bandhan Retirement Fund Direct – Growth?

Anyone who meets the eligibility criteria set by the fund house can invest in this scheme. Typically, there are no age restrictions, and both individual and joint investors can participate.

3. How does Bandhan Retirement Fund Direct – Growth work?

Investors contribute money into the fund, and the fund manager allocates these funds across various asset classes such as equity, debt, and other instruments. The fund’s performance depends on the market performance of these underlying assets.

4. What are the benefits of investing in this fund?

- Long-term Wealth Accumulation: It helps investors build a substantial retirement corpus over time.

- Tax Benefits: Investments in retirement funds often qualify for tax deductions under Section 80C of the Income Tax Act.

- Professional Management: The fund is managed by experienced professionals who make investment decisions on your behalf.

- Liquidity: While it’s a long-term investment, you can redeem your units as per the fund’s terms and conditions.

5. What is the minimum investment amount for Bandhan Retirement Fund Direct – Growth?.

The minimum investment amount may vary from one fund house to another, but typically, it ranges from ₹500 to ₹5,000.

6. Can I withdraw money from Bandhan Retirement Fund Direct – Growth before retirement?

Yes, you can withdraw your investment partially or in full as per the fund’s terms and conditions. However, early withdrawals may have certain restrictions and tax implications.

7. What is the ideal investment horizon for this fund?

Bandhan Retirement Fund Direct – Growth is designed for long-term wealth accumulation, ideally over 10 to 20 years or more. The longer you stay invested, the better your chances of accumulating a substantial retirement corpus.

8. How can I invest in this fund?

You can invest in Bandhan Retirement Fund Direct – Growth through various channels such as the fund house’s website, authorized distributors, or online investment platforms. You will need to complete the necessary KYC (Know Your Customer) requirements.

9. Are there any charges associated with this fund?

Yes, there may be charges such as expense ratios and exit loads. It’s essential to understand these charges before investing.

10. Is there a lock-in period for Bandhan Retirement Fund Direct – Growth?

Retirement funds typically have a lock-in period, which means you cannot redeem your investment before a specified age or tenure. The lock-in period may vary, so you should check the fund’s offer document for details.

11. What is the risk involved in investing in this fund?

Bandhan Retirement Fund Direct – Growth carries market risk, which means the value of your investment can fluctuate based on the performance of the underlying assets. It’s important to be prepared for short-term volatility while focusing on the long-term goal of retirement.

12. Can I switch between different mutual fund schemes under Bandhan Retirement Fund?

Yes, many retirement funds allow you to switch your investments between different schemes offered by the same fund house. This can be a useful feature if your investment goals or risk tolerance change over time.

13. How can I track the performance of my investments in Bandhan Retirement Fund Direct – Growth?

You can track your investments through periodic statements provided by the fund house. Additionally, you can monitor the fund’s performance in financial newspapers, the fund house’s website, or various financial apps and platforms.

14. Is Bandhan Retirement Fund Direct – Growth a guaranteed investment?

No, this fund, like all mutual funds, is subject to market risk. There are no guarantees of returns, and the performance of your investment depends on the performance of the underlying assets.

15. Can I take a loan against my investments in this fund for emergencies?

Some retirement funds may offer a loan facility, but the terms and conditions vary. You should check with the fund house for details on loan availability and terms.

16. What happens to my investments in Bandhan Retirement Fund Direct – Growth after I retire?

After retirement, you can redeem your investments as per the fund’s terms and conditions. Some retirement funds also offer options to receive periodic pension payments.

Please note that mutual fund investments are subject to market risks, and it’s advisable to consult with a financial advisor before making any investment decisions.

-

How India’s New Export Credit Policy Will Help Small Sellers on Amazon, Flipkart Commerce, and ONDC Go Global

📌 Quick Summary Under the Rs 25,060 crore Export Promotion Mission (EPM), the DGFT on March 6, 2026

-

HDFC Bank Cuts MCLR, Hikes FD Rates in Back-to-Back Moves: What It Means for Your Loan EMI and Fixed Deposit Returns

📌 Quick Summary Effective March 6, 2026: HDFC Bank raised FD interest rates by 10 bps for the

-

Yuva Sathi Status Check Online 2026: Step-by-Step Guide to Track Banglar Yuva Sathi Application for ₹1500 Monthly Aid

Yuva Sathi status check is a hot search right now, especially in West Bengal where the Banglar Yuva

-

Why Update to iOS 26.3.1 Right Now? CarPlay Stability Improvements and Studio Display Compatibility Details

iOS 26.3.1 dropped silently—fixing iPhone 17’s maddening keyboard lag & UI glitches most ignored. But wait: it secretly

-

Cooking Gas Cylinder Rate Increase Hits Hard — Home Meals and Restaurant Bills Set to Rise Together

It started with a missile strike in the Middle East. It ended with higher prices on your kitchen

-

Amazon Robotics Layoffs Explained: Why the Team Faces Cuts After 57,000 Corporate Reductions and What Blue Jay Shelving Reveals About AI Shifts.

Amazon’s robotics division, a cornerstone of its warehouse empire, is undergoing targeted layoffs in March 2026, just months

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!