9 Million US Student Loan Defaults: ₹50L US Loan Wipeout Now Taxable in India?

9M Americans defaulting on student loans? Shocking twist: Indian NRIs face wage seizures, slashed remittances, and a hidden tax bomb on forgiveness—could your family’s ₹10L dream turn into rupee ruin? Uncover the US debt tsunami’s secret India impact before 2026 repo hikes strike.

Funding your dream US master’s degree with a loan, only to return home trapped in endless debt—could India’s booming study-abroad frenzy lead to a similar crisis?

The US Student Loan Tsunami Exposed

In 2025, nearly 9 million Americans teeter on the edge of federal student loan default, with 5.8 million already 90+ days delinquent and projections of 1.8 million more hitting default by July. This crisis, fueled by post-pause payment restarts and Trump administration policies ending “illegal” forgiveness plans like SAVE, has pushed delinquency rates to a record 31%—triple pre-pandemic levels. Older borrowers, minorities, and non-graduates face the highest risks, with credit scores plummeting 60 points on average, triggering wage garnishments and ruined retirements.

Surprisingly, even “prime” borrowers—once low-risk—are defaulting at alarming rates, with 23% of 2025 cases from this group, shattering myths of who falls into the debt trap. Total US student debt hit $1.65 trillion, with 10% now seriously overdue amid rising collections. For Indians, this hidden shift—from subprime to everyday professionals—mirrors our own rising education loan disbursals crossing ₹90,000 crores annually.

Hidden Risks Lurking for Indian Students Abroad

Over 372,000 Indian students chase the "American Dream" in the US, but F-1 visa debt traps loom large with loans up to $100K (₹85 lakhs+). Rupee depreciation and a 44% drop in US visas (Oct 2024-Mar 2025) amplify costs, stranding graduates in job-scarce markets under anti-immigration policies. Real stories abound: One student borrowed $75K via Prodigy Finance, lost their job, and now faces legal threats, wage cuts, and a 7-year credit blacklist—echoing US defaults' lifelong scars.

Little-known: Indian banks classify US loans as high-risk amid 2025 "country risk zones," demanding collateral above ₹7.5 lakhs and rejecting unstable regions. Yet, demand surges 15-20% yearly, with abroad loans up to ₹1.5 crores at 9-14% interest—far lower than US rates but compounding fast if jobs falter.

Urgency strikes: RBI's 2025 MELS updates link rates to repo (now ~6.5%), but unchecked borrowing risks India's own "default cliff."

| Aspect | US Federal Loans (2025) | Indian Abroad Education Loans (2025) |

| Delinquency Rate | 31% (90+ days) | Rising; no official default data, but global warnings |

| Avg. Debt | $37K per borrower | ₹50L-₹1.5Cr; $100K common for US |

| Interest | 5-8% federal | 9-14%; repo-linked |

| Consequences | Wage garnishment, credit ruin | CIBIL drop, family co-signer liability |

| Relief Options | IDR paused; RAP proposed (30-yr) | 3% subvention if family income <₹8L |

How will US Student Loan Defaults affect Indian NRIs and Remittances

Rising US student loan defaults strain Indian NRIs through reduced disposable income and heightened financial stress, potentially trimming remittances by 5-10% from US-sourced flows in 2026.

Direct Impact on Indian NRIs

Over 372,000 Indian students and young professionals in the US grapple with federal loan delinquencies, where 42% struggle with basic bills amid wage garnishments up to 15% and tax refund seizures. NRIs on F-1/OPT/H-1B visas face amplified risks: defaults slash credit scores, complicating visa renewals, job stability, and even triggering family co-signer liabilities back home—potentially forcing returns or legal woes. Trump's 2025 push to privatize $1.6T loans ends flexible IDR/forgiveness, hiking EMIs 20-30% for borrowers, many Indians with $75K+ debts.

Remittance Flow Disruptions

India's $135.6B remittances hit a 5-year high in FY25, but US student/NRI stress could dent the US share (20-25% of total), mirroring a 16-22% drop in education-related outflows amid visa curbs. Defaults curb spending power: NRIs prioritizing EMIs over family transfers, with real cases of grads unable to pay rent post-loan hits. New 1% US remittance tax adds ₹1,000 per ₹1L sent, accelerating caution—Gujarat alone saw ₹10K Cr NRI deposit surges from dollar strength, but defaults reverse this.

| Factor | NRI Impact | Remittance Effect |

| Defaults (9M+ US) | Wage cuts, 60-177 pt credit drop | -5-10% US-India flows |

| Privatization Plan | Lost forgiveness, higher rates | Hesitant transfers amid tax |

| Visa/Job Risks | H-1B instability | 16% education remittance dip |

| Family Co-signers | India legal drag | Prioritize survival over sends |

Broader Indian Economy Ties

Remittances fuel 3% of GDP; a US default wave amid recession fears (layoffs hitting H-1Bs) echoes in rupee volatility, but RBI buffers via steady repo (6.5%).

Positive offset: Dollar rally boosted Q2 FY26 deposits ₹10K Cr, yet student debt tsunami risks 14% projected FY25 growth slowdown.

Action Steps for NRIs/Families:

- Consolidate Loans: Enroll in RAP (30-yr plans) before privatization; refinance via Indian banks at 9-11%.

- Remit Smart: Use fintech (Wise/Paytm) to dodge 1% tax markups; lock FCNR at 7-8% yields.

- Build Buffer: 6-12 months EMIs in liquid funds; monitor CIBIL to shield family guarantors.

- Diversify: Shift 20% to India SIPs—12% returns beat US stress.

What are Tax Implications in India if US Loan Forgiveness Becomes Taxable

US student loan forgiveness remains federally tax-free if processed by December 31, 2025, under the ARPA extension, but post-2025 discharges revert to taxable income in the US—potentially triggering Indian tax scrutiny for NRIs/residents as "other income" if remitted or accrued.

US Tax Shift Mechanics

Trump-era policies end Biden's tax shield after 2025, treating forgiven amounts (e.g., $50K on a $75K loan) as ordinary income at 10-37% federal rates, plus state taxes in places like North Carolina. NRIs qualify for 2025 exemptions via IDR plans (ICR/PAYE), but SAVE remains blocked—no tax if eligibility hits this year, even if processed later. Form 1099-C reports discharge; DTAA (US-India Article 21) may cap double taxation via foreign tax credits.

Indian Tax Treatment Breakdown

India taxes NRIs/residents on global income if resident (>182 days stay or deemed resident); forgiven US debt counts as "income from other sources" (Section 56), fully taxable at slab rates (up to 30% + surcharge) with no specific exemption. No direct precedent, but akin to lottery/gifts: Taxable unless DTAA deems it non-accruing in India. Liberalized Remittance Scheme (LRS) TCS (0.5-5%) applies only to outward education remittances, not inbound forgiveness. Section 80E deducts interest on Indian education loans (8 years, no limit), irrelevant here.

| Status | Taxable in India? | Key Rules |

| Resident Indian | Yes, global income | Slabs 0-30%; report in ITR-2/3 |

| NRI | No, if US-sourced only | India income (rent/dividends) taxed; DTAA credit |

| Forgiveness Amount | Taxable as "other income" | No 80E; claim US tax paid |

| Remitted to India | Triggers scrutiny | FEMA ok, but ITR disclosure mandatory |

DTAA & Reporting Nuances

US-India treaty (Article 21/22) allows standard deductions for students; forgiven debt likely taxable in US first, creditable in India via Form 67. Residents file ITR by July 31 (AY 2026-27); NRIs only on India income (>₹2.5L). Penalty risk: 50-200% for non-disclosure; audit flags large "gains." Real relief: Pre-2026 forgiveness locks tax-free status.

Action Steps:

- Lock Forgiveness Now: Qualify under ICR/PAYE before 2025 ends—consult US servicer.

- Claim DTAA Credit: File Form 67 with ITR; retain 1099-C.

- Track Residency: Use <182 days to stay NRI; report via ITR-2.

- Consult CA: Pre-empt via advance ruling; hedge with 80C investments.

RBI & SEBI 2025 Updates: Your Debt Shields

RBI's Model Education Loan Scheme (MELS 2025) mandates no upper limit on loans but eases collateral: nil up to ₹4L, third-party guarantee ₹4-7.5L, tangible assets above. Transparent repo-linked rates and OCI inclusion boost access, with 15-day approvals for public banks—relief amid inflation. PM-Vidya Lakshmi offers 3% interest subvention on ₹10L for low-income families, slashing EMIs via streamlined portals.

SEBI's debt market reforms harmonize securitization, enabling banks to offload education loans via Structured Debt Instruments (SDIs) with ₹1Cr min. ticket for institutions—freeing capital but sidelining retail.

Aspiration alert: Use this for wealth-building; low-risk debt funds (yields 7-9%) beat loan costs. Why care? These shield against US-style defaults, but urgency looms—apply before Q1 2026 repo hikes.

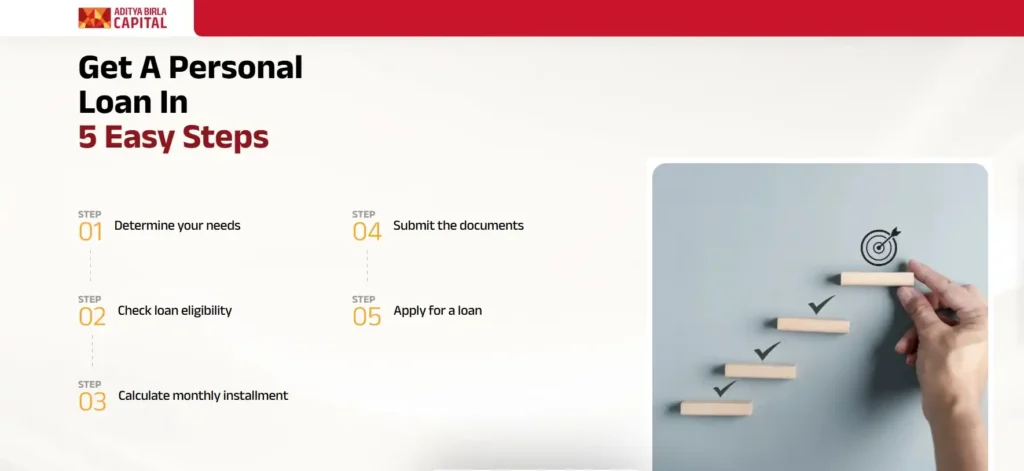

- Step 1: Check eligibility on Vidya Lakshmi portal (income <₹8L for subvention).

- Step 2: Compare rates: SBI (9.5%), HDFC (11%); pledge FDs/MFs as collateral.

- Step 3: Moratorium till course end + 6 months—use for upskilling.

Financial Concepts Demystified for Indians

Credit Scores (CIBIL): Like US FICO, a 90-day miss drops 100+ points, blocking home/car loans for 7 years. US defaulters lose jobs; Indians risk family guarantor blacklisting. Build via timely EMIs.

Loan Repayment (EMI Calc):

Formula: EMI=P×r×(1+r)n/((1+r)n−1)EMI=P×r×(1+r)n/((1+r)n−1), where P=principal, r=monthly rate, n=tenure. ₹50L at 11% over 10yrs = ₹66K/month—relief via IDR-like extensions.

Fintech Apps: Use Cred/Paytm for EMI tracking; Groww for debt funds yielding 8% to offset inflation (6%+ in 2025). Avoid scams—RBI warns of fake abroad lenders.

Investment Tie-In: SEBI's 2025 mutual fund inflows (₹22K Cr debt Dec) fund SIPs at 12% equity returns, aspiring financial freedom.

| Tool | Use for Relief | Urgency (2025) |

| CIBIL Monitor | Track score free | Pre-loan check; rising delinquencies |

| Debt Funds | 7-9% yields | Inflation hedge; SEBI reforms boost liquidity |

| Refinance Apps | Lower rates 1-2% | RBI 15-day rule ends delays |

Actionable Takeaways: Secure Your Future Now

Immediate Money Moves:

- Audit Loans: List all debts; use RBI's Vidya Lakshmi for consolidation—save 2% interest.

- Build Emergency Fund: 6 months' EMIs in liquid funds (7% yield)—avoids US-style job-loss defaults.

- Upskill Fast: Free Coursera certs boost employability 30%; target ₹15L+ salaries to crush EMIs.

- Family Huddle: Co-signers? Share CIBIL risks; opt collateral-free <₹7.5L.

- Invest Smart: ₹5K/month SIP in debt hybrids—compound to ₹10L in 10yrs, funding kid's education sans debt.

Relief awaits: 2025 schemes cut costs 20-30%; act before rupee dips further.

Aspire big—financial freedom trumps debt slavery.

Final Thought

As US defaults cascade under Trump-era crackdowns, India's ₹90K Cr education loan boom whispers a warning: unchecked ambition breeds traps. Yet, RBI/SEBI shields—subventions, repo-linked rates, debt funds—offer relief and aspiration for wealth-building. Imagine debt-free freedom: EMIs paid, SIPs compounding at 12%, kids studying sans stress. But urgency bites—2026 repo hikes, rupee volatility, SEBI's SDI shifts could spike costs 2-3%. Don't sleep: Audit today, upskill tomorrow, invest now. The real shock? India's crisis brews not in defaults, but ignored safeguards. Teaser: With NITI's bond market push and AI-job disruptions, will 2026 unveil "India's RAP"—a 30-year forgiveness flop or homegrown revolution? Stay ahead; your rupee revolution starts here.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!