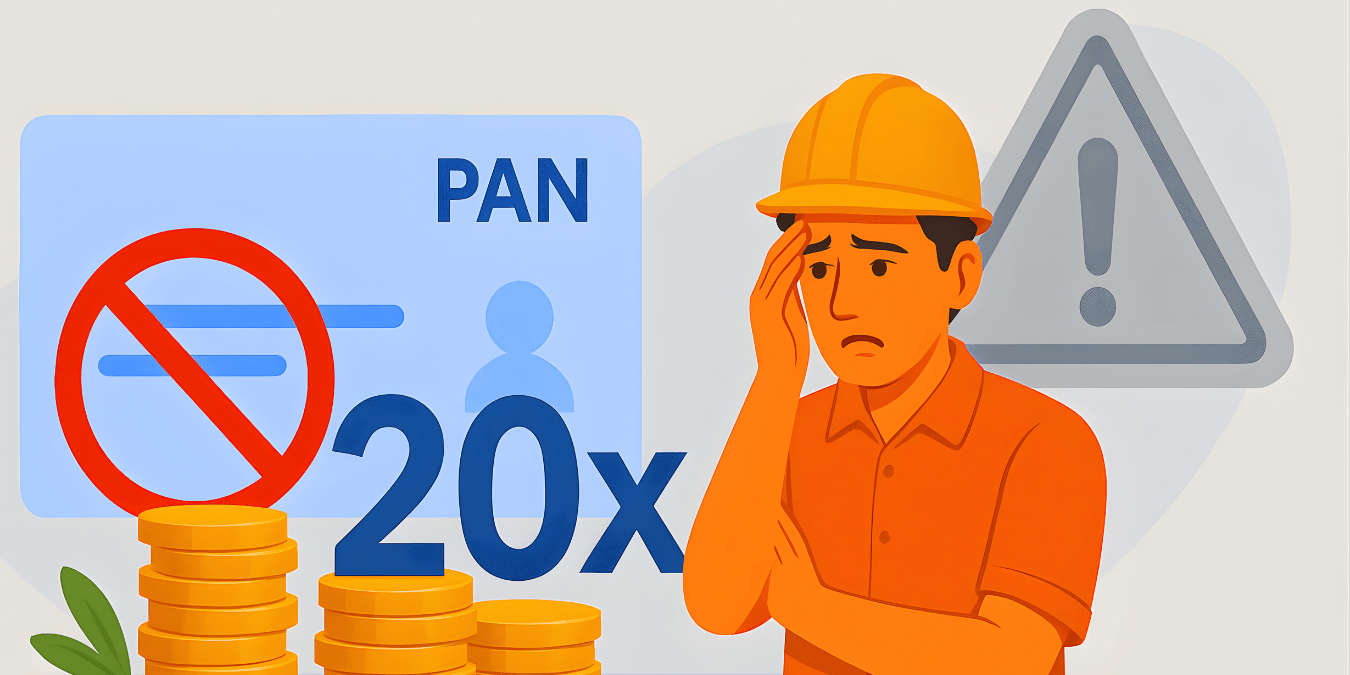

The Hidden TDS Trap: Why Your Unlinked PAN Could Cost Contractors 20x More in 2025

Shocking TDS Trap: Unlinked PAN turns ₹5L contractor bill into ₹1L tax bomb under 194C—yet CBDT’s secret 2025 relief erases it if you act NOW! Homeowners exempt from 20x hikes? Hidden rules, MSME escapes, and Budget 2026 biometrics looming—don’t pay extra!

Paying a contractor ₹5 lakh for home renovation, only to face a shocking ₹1 lakh tax demand because of a simple linking oversight—yet recent CBDT relief could erase it if you act by September 30. In 2025, with Budget tweaks and digital enforcement tightening, PAN-Aadhaar linkage silently dictates Section 194C TDS fate for millions of Indian businesses and freelancers chasing financial freedom. This post uncovers little-known relief windows, penalty pitfalls, and urgent steps to dodge rising compliance risks amid inflation and scam surges, empowering you to reclaim cash flow and build wealth stress-free. (148 words)

Section 194C Basics

Section 194C mandates TDS on payments to contractors for work like construction, advertising, or labor supply when exceeding ₹30,000 per contract or ₹1 lakh annually for most payers. Individuals/HUFs deduct at 1%, others at 2%, but thresholds remain unchanged post-Budget 2025 unlike rent TDS hikes to ₹6 lakhs. Real-world hit: A Delhi builder paying a painter ₹40,000 triggers 1% TDS (₹400), deposited by the 7th of next month via Form 26Q.

Failure here blocks 30% expense claims under Section 40(a)(ia), piling interest at 1-1.5% monthly. Urgency strikes freelancers: With gig economy booming 25% yearly per RBI data, unlinked IDs amplify cash crunches.

PAN-Aadhaar Power Play

Unlinked PAN turns "inoperative" post-July 2023, invoking Section 206AA for 20% TDS—10x the normal rate on 194C payments. Hidden twist: Even valid PANs fail without Aadhaar, hitting contractors hardest in MSME-heavy India where 63 million units operate. Example: ₹2 lakh sub-contractor bill jumps from ₹2,000 (1%) to ₹40,000 TDS, refundable only via ITR but delaying working capital.

Aspiration alert: Linked IDs unlock seamless refunds, boosting liquidity for wealth-building via investments. Relief breathes easy—CBDT Circular 9/2025 waives higher rates for April 2024-July 2025 transactions if linked by Sept 30, 2025. This time-bound grace shields payers from notices, a game-changer amid 2025's e-invoicing push.

Penalties Unleashed

Non-deduction invites 1% monthly interest if skipped, 1.5% if deducted late, plus ₹200/day for delayed Form 26Q (capped at TDS amount). PAN-missing bombshell: Payers face demands for shortfalls, as seen in Q2 FY24 notices treating inoperative PANs as invalid. Case insight: A Mumbai firm deducted 1% on ₹10 lakh but got hit for 19% extra (₹1.9 lakh) due to contractor's unlinked PAN, resolved post-linkage per CBDT relief.

Urgency peaks: Post-Sept 30, 2025, no mercy—20% sticks, inflating costs amid 7% inflation eroding margins. Emotional relief: Linking slashes scam risks in freelance platforms like UrbanClap, where fake IDs proliferate.

| Non-Compliance Issue | Penalty/Interest | 194C Example (₹5 Lakh Payment) |

| No TDS Deducted | 1%/month + 30% expense disallowance | ₹62,500 extra tax liability |

| Late Deposit | 1.5%/month | ₹7,500 for 1-month delay |

| Inoperative PAN | 20% TDS (vs 1-2%) | ₹98,000 vs ₹5,000-10,000 |

| Late TDS Return | ₹200/day | ₹40,000 max for 200 days |

What Penalties Apply for Short Deduction Under Section 194C

or short deduction of TDS under Section 194C, payers face interest charges and disallowance of related expenses, with no fixed penalty but strict enforcement via notices.

Interest Charges

Short deduction—deducting less than the required 1% (individuals/HUFs) or 2% (others) on contractor payments—attracts 1% per month interest from the deduction due date until payment. Late deposit after deduction adds 1.5% monthly from the 7th of the following month. Example: On a ₹5 lakh payment, short-deducting ₹3,000 TDS triggers ₹300 monthly interest, compounding quickly amid 2025's quarterly audits.

Expense Disallowance

Unpaid or short TDS blocks 30% of the expense claim under Section 40(a)(ia) in the payer's ITR, inflating taxable income. A ₹10 lakh contractor bill with ₹15,000 short TDS disallows ₹3 lakhs, adding ₹90,000+ tax at 30% slab. Relief note: Payment before return filing restores eligibility.

Additional Consequences

Delayed quarterly returns (Form 26Q) incur ₹200 daily fees, capped at TDS amount. Inoperative PANs escalate to 20% TDS demands under Section 206AA. CBDT's 2025 relief waives some notices if rectified by September 30, but short deductions persist.

| Violation Type | Penalty/Interest Rate | Example on ₹5 Lakh Payment (1% TDS = ₹5,000) |

| Short Deduction | 1%/month | ₹500/month interest |

| Late Deposit | 1.5%/month | ₹750 for 1 month |

| Expense Block | 30% disallowance | ₹1.5 lakh extra taxable |

| Late Return | ₹200/day | ₹20,000 max (100 days) |

Which Deductions are Exempt from Higher TDS Under 206AA for 194C Payments

Individuals and HUFs (not carrying on business/profession) deducting TDS under Section 194C at 1% remain exempt from Section 206AA's higher 20% rate, even for inoperative PANs—unlike others facing the top-up.

Exempt Deductors

Section 206AA's higher TDS applies only to deductors liable for 2% or more under the base provision; 194C's 1% payers (individuals/HUFs without business) skip it entirely. CBDT Circular 11/2021 clarified this exemption persists post-PAN-Aadhaar rules, shielding homeowners from 20% shocks on renovation payments. Example: A salaried individual paying ₹5 lakh to a plumber deducts ₹5,000 (1%) regardless of contractor's PAN status—no 20% escalation.

This carves out relief for 40% of 194C transactions in residential segments amid 2025's housing boom.

Non-Exempt Deductors

Companies, firms, and business-carrying individuals/HUFs (2% rate) must apply 20% if payee PAN is inoperative, unless CBDT relief applies. Post-September 2025, no waivers—full enforcement via AIS mismatches.

| Deductor Type | Base 194C Rate | 206AA Higher Rate Applies? | Example Impact (₹5 Lakh Payment) |

| Individual/HUF (no business) | 1% | No | ₹5,000 TDS max |

| Individual/HUF (with business) | 2% | Yes | ₹1 lakh if inoperative PAN |

| Companies/Firms | 2% | Yes | ₹1 lakh if inoperative PAN |

| Govt Entities | 2% | Yes (with exceptions) | ₹1 lakh if inoperative PAN |

Practical Implications

Exempt deductors still face interest for short deduction (1%/month) but dodge PAN-driven hikes, easing compliance for retail payers. Verify status via Form 15G/H for nil TDS if applicable. Action: Confirm your category on e-filing portal to budget accurately amid Q4 deadlines.

2025 Game-Changers

Budget 2025 skipped 194C tweaks but eased others like 194H brokerage threshold to ₹20,000 at 2%. CBDT's July 2025 circular offers retrospective relief: Link by Sept 30 for past shortfalls, nullifying demands—a silent savior for 2 crore+ unlinked PANs. Trend tie-in: SEBI-RBI fintech crackdowns mandate real-time PAN-Aadhaar checks, flagging 15% more mismatches in Q3 2025.

Little-known: Transporters escape TDS with declaration, but PAN lapse voids it—vital for logistics amid ₹20 lakh crore infra push. Aspiration fuel: Compliant firms access easier MSME loans at 7.95% via ECLGS extensions.

Actionable Steps Now

- Verify Status: Check PAN-Aadhaar at incometax.gov.in—"inoperative" screams action.

- Link Instantly: Use e-filing portal; pay ₹1,000 late fee if post-June 2023—activates in 48 hours.

- Log in with PAN/pre-login.

- Select "Link Aadhaar," enter details/OTP.

- Pay via net-banking; get instant acknowledgment.

- TDS Compliance: Demand contractor PAN pre-payment; deduct 20% if unlinked, claim relief later. Use AIS portal for mismatch fixes.

- Money Move: Budget ₹500/month for CA tools like ClearTax to automate, freeing ₹10,000 yearly in penalties for SIPs.

Track via TRACES; issue Form 16A quarterly. Implement today—save ₹50,000+ on next project.

Contractor Survival Kit

Freelancers, demand lower/nil TDS via Form 13/197 certificate if low income.

Payers: Segregate labor/material invoices to TDS only services. Real relief: Post-linkage, e-returns process 30% faster, slashing refund waits from 6 to 2 months.

Urgency hack: With Dec 31 quarterly deadline looming, link now to dodge Jan 2026 audits amid AI-driven scrutiny. Share this: Friends in construction/manpower lose ₹5-10 lakh yearly—tag them!

In 2025's compliance storm, PAN-Aadhaar isn't bureaucracy—it's your shield against 20x TDS shocks, unlocking financial freedom. Yet whispers of Budget 2026's AI-TDS trackers and mandatory biometrics hint at tougher enforcements—will unlinked PANs face outright bans? Stay linked, stay ahead; the next policy shift could redefine your wealth game.

Final Thought

In 2025's compliance storm, PAN-Aadhaar linkage emerges as the ultimate shield against Section 194C's hidden TDS traps—slashing 20x penalty risks for businesses and freelancers alike. CBDT's Circular 9/2025 relief window, closing post-September, has already nullified lakhs of notices, but short deductions still sting with 1-1.5% monthly interest and 30% expense blocks, hitting MSMEs hardest amid 7% inflation. Homeowners breathe easy as 1% deductors dodge Section 206AA hikes entirely, reclaiming cash for wealth-building SIPs or debt payoffs. Yet urgency looms: Q4 audits and AI-driven AIS scrutiny demand immediate verification and rectification. Act now—link, comply, automate via fintech—to unlock financial freedom, sidestep scams, and fuel aspirations like homeownership in India's booming infra wave. Whispered Budget 2026 shifts hint at biometric mandates and real-time TDS trackers; ignore at your peril, or thrive ahead in the digital tax era. Stay linked, stay sovereign.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!