The Basmati Betrayal? What Really Sparked Trump’s "Rice Rage" And Why India Should Worry

Why did Donald Trump suddenly lash out at Indian rice exports just as global prices cooled and India lifted its bans? Discover the hidden US farm lobby pressures, quiet tariff moves and political gambits that could reshape basmati, farmers’ incomes and India–US ties across 2026 in ways Indians don’t expect.

The Storm in a Rice Bowl

It started with a casual complaint in a White House conference room, but by the time the meeting ended, Indian stock markets were trembling. You might have heard the headline: Donald Trump, comfortably settled into his second term as President in late 2025, has lashed out at Indian rice exports. But if you think this is just another standard “tariff tantrum,” you are missing the most critical piece of the puzzle.

Here is the question that should keep every Indian exporter awake tonight: Why did a President, who just six months ago claimed to be India’s “best friend,” suddenly accuse New Delhi of “dumping” its most prized agricultural asset?

The answer isn’t just about economics; it’s about a hidden political maneuver involving a Louisiana miller, a $12 billion handout, and a “silent” trade war that began back in August 2025—one that most Indian media missed. While the world was watching the dollar, Trump was quietly rewriting the rules of engagement with New Delhi.

In this deep dive, we peel back the layers of the December 8th outburst. We will uncover the surprising “Puerto Rico connection,” the backfire of India’s own policy success, and the specific warning signs that suggest this is just the opening salvo in a much larger battle for 2026. This isn’t just about rice; it’s about the future of India’s place in the “America First” economy.

The Anatomy of an Outburst: Inside the White House Roundtable

To understand the severity of the threat, we must first reconstruct the scene. On Monday, December 8, 2025, President Trump hosted a roundtable with key agricultural stakeholders and cabinet members, including Agriculture Secretary Brooke Rollins and Treasury Secretary Scott Bessent. The agenda was ostensibly about supporting American farmers, but it quickly pivoted to finding a scapegoat for their struggles.

The spark came from Meryl Kennedy, a rice miller from Louisiana. Seated next to the President, Kennedy painted a dire picture of the Southern US rice industry. She claimed that American producers were "really struggling" because foreign competitors were undercutting them. When Trump pressed her for names—asking specifically "which countries"—Kennedy didn’t hesitate. She pointed the finger directly at India and Thailand.

But here lies the first "hidden" detail that most reports glossed over: Kennedy also mentioned China dumping rice into Puerto Rico. She noted that Puerto Rico, once a major market for US rice, had been lost to Chinese imports. Yet, in typical Trumpian fashion, the President’s ire zeroed in almost exclusively on India.

"They shouldn't be dumping. I mean, I heard that, I heard that from others. You can't do that," Trump declared.

He didn't just stop at rhetoric. He turned to his Treasury Secretary, Scott Bessent, and effectively ordered him to "take care" of the issue, floating the idea of punitive tariffs as a swift remedy. This wasn't a vague threat; it was a directive issued in front of cameras, designed to show immediate action.

Why this matters now:

The specificity of the interaction is chilling. This wasn't a prepared policy speech; it was a reactive policy-making session driven by a single anecdote. For India, this means trade policy is no longer being shaped by diplomats in the State Department, but by the loudest voices in the room with the President. The "outburst" was a calculated performance to justify the $12 billion federal aid package he was announcing simultaneously. By blaming India for "dumping," Trump validates the narrative that American farmers are victims of foreign cheating, rather than market inefficiencies.

The "Silent" Trade War: The August 2025 Precedent

If you are shocked by the December threat, you haven't been paying attention to the timeline. The "outburst" didn't happen in a vacuum. It was fueled by a precedent set just months earlier—a development that constitutes the "silent" phase of this trade war.

In August 2025, the Trump administration quietly implemented a staggering 50% tariff on a wide range of Indian goods. This move was triggered by a cocktail of disputes, including India's purchase of Russian oil and disagreements over digital services taxes.

This 50% tariff wall is the "elephant in the room" that makes the new rice threat so dangerous.

- The Cumulative Effect: Indian exporters are already bleeding from the August hikes. A new layer of tariffs on rice—specifically targeting Basmati and non-Basmati varieties—wouldn't just reduce margins; it could make Indian rice mathematically unviable in the US market compared to competitors like Pakistan, which faces significantly lower duties (only roughly 19% extra levy compared to India's 50%).

- The "Reciprocal" Trap: Trump has long labeled India a "tariff king." His logic for the August tariffs was "reciprocity." Now, he is using the "anti-dumping" label to go beyond reciprocity. "Dumping" implies illegal trade practices—selling below cost to kill competition. This label allows the US to impose duties on top of existing tariffs, potentially pushing the total tax burden to prohibitive levels.

The "August Precedent" proves that Trump 2.0 is willing to execute on threats that sounded like bluffs in his first term. The 50% tariff was the warning shot; the attack on rice is the precision strike.

The Irony of Success: How Lifting the Ban Backfired

Here is the most frustrating aspect for Indian policymakers: The "dumping" accusation is a direct result of India doing exactly what the world asked it to do.

Throughout 2023 and 2024, India—the world's largest rice exporter—had imposed severe restrictions and bans on rice exports to control domestic inflation. The world, including the US and the WTO, clamored for India to lift these bans to ensure global food security.

India listened. Between September 2024 and March 2025, the Indian government systematically lifted these bans, removing the final barriers on broken rice in March 2025.

- The Result: A massive surge in supply.

- The Consequence: Global rice prices crashed by 29% in 2025.

This price correction was a boon for starving nations in Africa and Asia. But in the protectionist eyes of the US rice lobby, this wasn't a market correction—it was "dumping."

By flooding the market and lowering prices (which was the humanitarian goal), India inadvertently handed Meryl Kennedy and the US rice lobby the perfect weapon. They could point to the sharp drop in prices as "proof" that India was selling below fair market value.

The "Little-Known" Twist:

The US Department of Agriculture (USDA) likely knows that Indian Basmati doesn't directly compete with the long-grain rice grown in Louisiana. Basmati is a premium, aromatic grain with a Geographical Indication (GI) tag. Louisiana grows commodity rice. They are different products for different consumers. Yet, by lumping them together under the "rice" umbrella, the Trump administration is using a technicality to protect a domestic industry that is suffering more from global oversupply than specific Indian competition.

The Fallout: Panic in the Mandis and Markets

The reaction in India has been swift and fearful, providing a real-time glimpse into the anxiety gripping the sector.

1. The Stock Market Shudder

On the morning of December 9, 2025, just hours after the White House comments circulated, shares of major Indian rice exporters took a nose-dive. Companies like KRBL (makers of India Gate Basmati) and LT Foods (Daawat brand) saw their stocks fall by up to 8%. Investors know that the US is a high-value market. Even though it represents only about 3% of India's total rice export volume, it accounts for a disproportionate chunk of profit due to the premium pricing of Basmati in American supermarkets.

2. The Exporter's Dilemma

Exporters are now facing a "double whammy."

- Tariff Barrier: The existing August tariffs had already squeezed margins.

- Psychological Barrier: The "dumping" label taints the brand. If the US officially investigates India for dumping, it drags exporters into costly legal battles and subjects them to retroactive taxes.

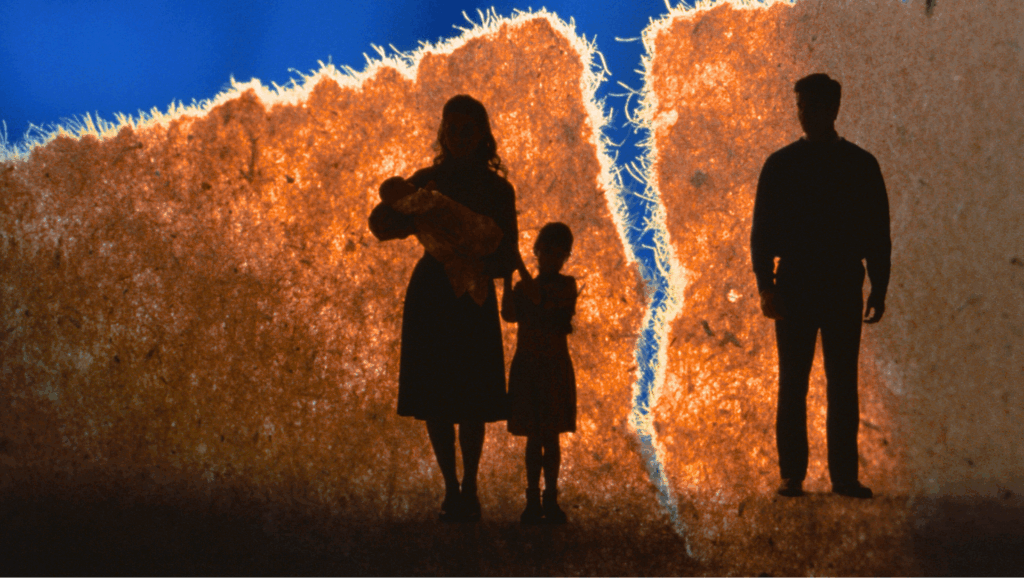

3. The Farmer's Plight

For Indian farmers, especially in Punjab and Haryana, this news comes at the worst possible time. They had just started to enjoy the freedom of unrestricted exports after the long ban. Prices in local mandis (markets) had stabilized. If exporters pull back due to fear of US sanctions, domestic procurement prices could crash, leading to renewed agrarian distress just as the government is trying to manage rural sentiment.

Expert Insight: Is It Really "Dumping"?

To separate political rhetoric from economic reality, we must ask: Is India actually dumping rice?

According to trade experts, the answer is a resounding no.

- Price Premium: Indian Basmati sells at a premium over most other rice varieties. "Dumping" usually involves selling cheap junk. Basmati is the champagne of rice. It is inherently expensive.

- Currency Arbitrage: The Indian Rupee has depreciated against the US Dollar in 2025, making Indian exports naturally cheaper in dollar terms. This is basic macroeconomics, not predatory pricing.

- The "Subsidy" Argument: Trump and US farmers often argue that Indian farmers are heavily subsidized (fertilizer, power, MSP). They view these domestic supports as unfair trade advantages. While India defends these as essential for food security, the US frames them as export subsidies.

The reality is that US farmers are struggling because their production costs are high, and they cannot compete with the natural advantages of Asian rice bowls. Instead of innovating, they are lobbying for protection. Trump, needing the rural vote and wanting to appear tough, is happy to oblige.

The Geopolitical Chessboard: What Happens Next?

The timing of Trump’s outburst is not accidental. It coincided perfectly with a scheduled visit by a US trade delegation to India on December 10-11, 2025.

This is a classic Trump negotiation tactic: "The Art of the Deal" 2.0.

- Create a Crisis: Threaten a massive new tariff or investigation just days before a meeting.

- Gain Leverage: Force the other side (India) to come to the table desperate to avoid the penalty.

- Extract Concessions: Demand lower tariffs on US products (like Harley Davidsons, apples, or almonds) in exchange for "holding off" on the rice tariffs.

The Indian delegation is now walking into the December 10 talks with a gun to their head. The agenda has shifted from "how can we grow trade?" to "how can we save our rice exports?"

The China Factor:

Don't forget the Puerto Rico comment. By lumping India in with China, Trump is signaling that he views all Asian exporters as part of the same problem. This is dangerous for India, which has tried to position itself as a strategic counterweight to China and a "friend-shore" partner to the US. Trump’s outburst suggests that when it comes to "America First," friends and foes effectively look the same if they run a trade surplus.

Actionable Takeaways for the Indian Audience

If you are reading this in India in late 2025, here is what this means for you:

- For Investors: Be extremely cautious with agri-commodity stocks (KRBL, LT Foods, Chaman Lal Setia) for the next quarter. Volatility will be high until the "dumping" investigation is clarified. Watch for the outcomes of the Dec 10-11 meetings.

- For Exporters: It is time to aggressively diversify. Reliance on the US market is becoming a liability. Look to the Middle East (which remains the biggest buyer) and Europe, but be wary—if the US labels India a "dumper," other nations might follow suit to protect their own farmers.

- For Consumers: Ironically, if exports to the US collapse, domestic supply might increase, potentially lowering the price of premium Basmati in your local supermarket. A small silver lining for the Indian housewife, perhaps?

Final Thought: The Era of Uncertainty

Donald Trump’s outburst over Indian rice is not just about grains; it is a warning siren for the entire Indian economy. It demonstrates that in 2025, no sector is safe from the crosshairs of American protectionism, regardless of strategic partnerships or "friendships."

The lifting of the export ban, hailed as a victory for free trade and food security, has been twisted into a weapon against Indian farmers. As the US trade delegation lands in Delhi, the question isn't just whether they will impose tariffs on rice. The question is: What will they target next?

Pharmaceuticals? Textiles? IT services? The rice outburst proves that the "Reciprocal Trade Act" is not just a slogan—it’s a hunting license. And right now, India is the prey.