This summary provides a comprehensive overview of the Manba Finance IPO, highlighting key details and investor interest:

- Strong Investor Response: The Manba Finance IPO was fully subscribed within minutes of opening on September 23, 2024.

- Subscription Details: The IPO saw significant interest from retail and high-net-worth individual (HNI) investors.

- Price Band: Shares were offered in the price band of ₹114-₹120 per share.

- IPO Size: The company aimed to raise ₹150.84 crore through the IPO, with a fresh issue of 1,25,70,000 equity shares.

- Oversubscription: By noon on the first day, investors had bid for 6,83,20,875 equity shares, which is 7.76 times the 87,99,000 shares on offer.

- Retail and NII Interest: The retail portion was subscribed 10.78 times, while the NII portion saw a subscription of 10.63 times.

- Grey Market Premium: The grey market premium (GMP) for Manba Finance shares was around ₹60, indicating a potential 50% listing gain.

- Company Background: Established in 1998, Manba Finance is a non-banking finance company (NBFC) offering loans for two-wheelers, three-wheelers, used cars, small businesses, and personal loans.

- Market Presence: The company operates in six states: Maharashtra, Gujarat, Rajasthan, Chhattisgarh, Madhya Pradesh, and Uttar Pradesh.

- Brokerage Views: Brokerage firms have a positive outlook on the IPO, citing strong financials and growth potential, though they note concerns about rising capital costs and bad loans.

-

How India’s New Export Credit Policy Will Help Small Sellers on Amazon, Flipkart Commerce, and ONDC Go Global

📌 Quick Summary Under the Rs 25,060 crore Export Promotion Mission (EPM), the DGFT on March 6, 2026

-

HDFC Bank Cuts MCLR, Hikes FD Rates in Back-to-Back Moves: What It Means for Your Loan EMI and Fixed Deposit Returns

📌 Quick Summary Effective March 6, 2026: HDFC Bank raised FD interest rates by 10 bps for the

-

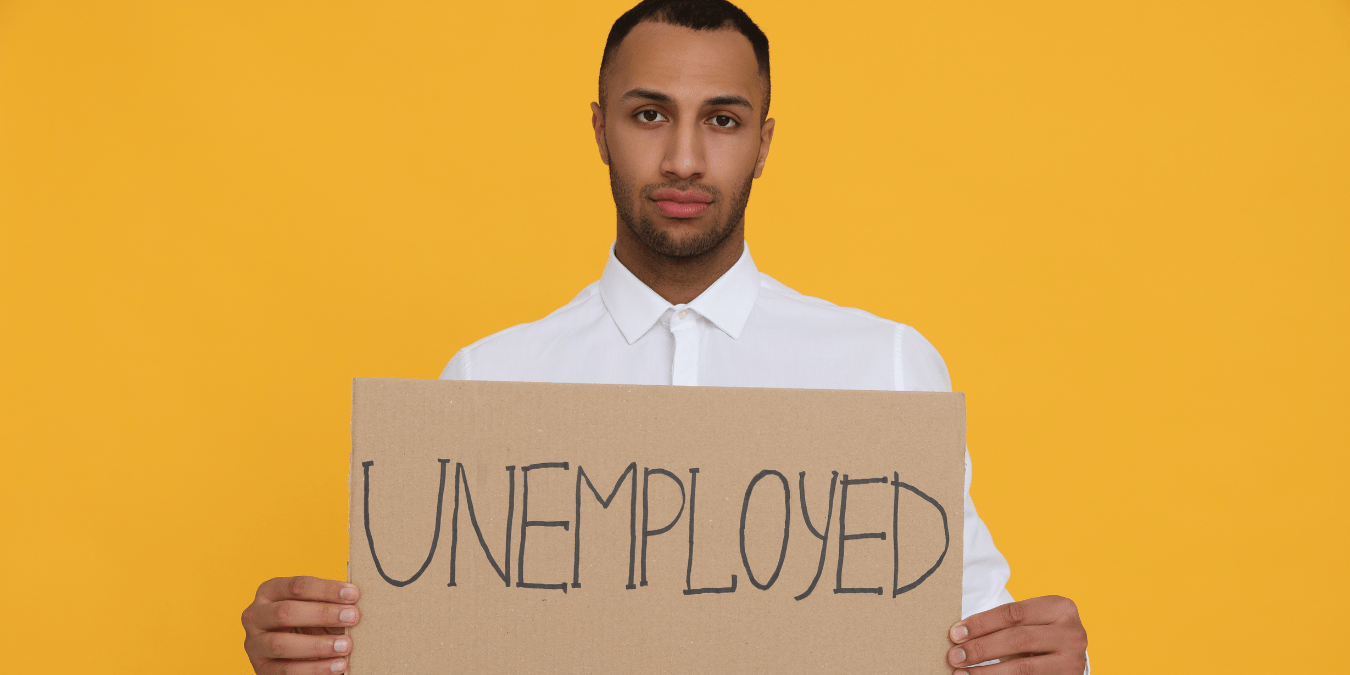

Yuva Sathi Status Check Online 2026: Step-by-Step Guide to Track Banglar Yuva Sathi Application for ₹1500 Monthly Aid

Yuva Sathi status check is a hot search right now, especially in West Bengal where the Banglar Yuva

-

Why Update to iOS 26.3.1 Right Now? CarPlay Stability Improvements and Studio Display Compatibility Details

iOS 26.3.1 dropped silently—fixing iPhone 17’s maddening keyboard lag & UI glitches most ignored. But wait: it secretly

-

Cooking Gas Cylinder Rate Increase Hits Hard — Home Meals and Restaurant Bills Set to Rise Together

It started with a missile strike in the Middle East. It ended with higher prices on your kitchen

-

Amazon Robotics Layoffs Explained: Why the Team Faces Cuts After 57,000 Corporate Reductions and What Blue Jay Shelving Reveals About AI Shifts.

Amazon’s robotics division, a cornerstone of its warehouse empire, is undergoing targeted layoffs in March 2026, just months

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!