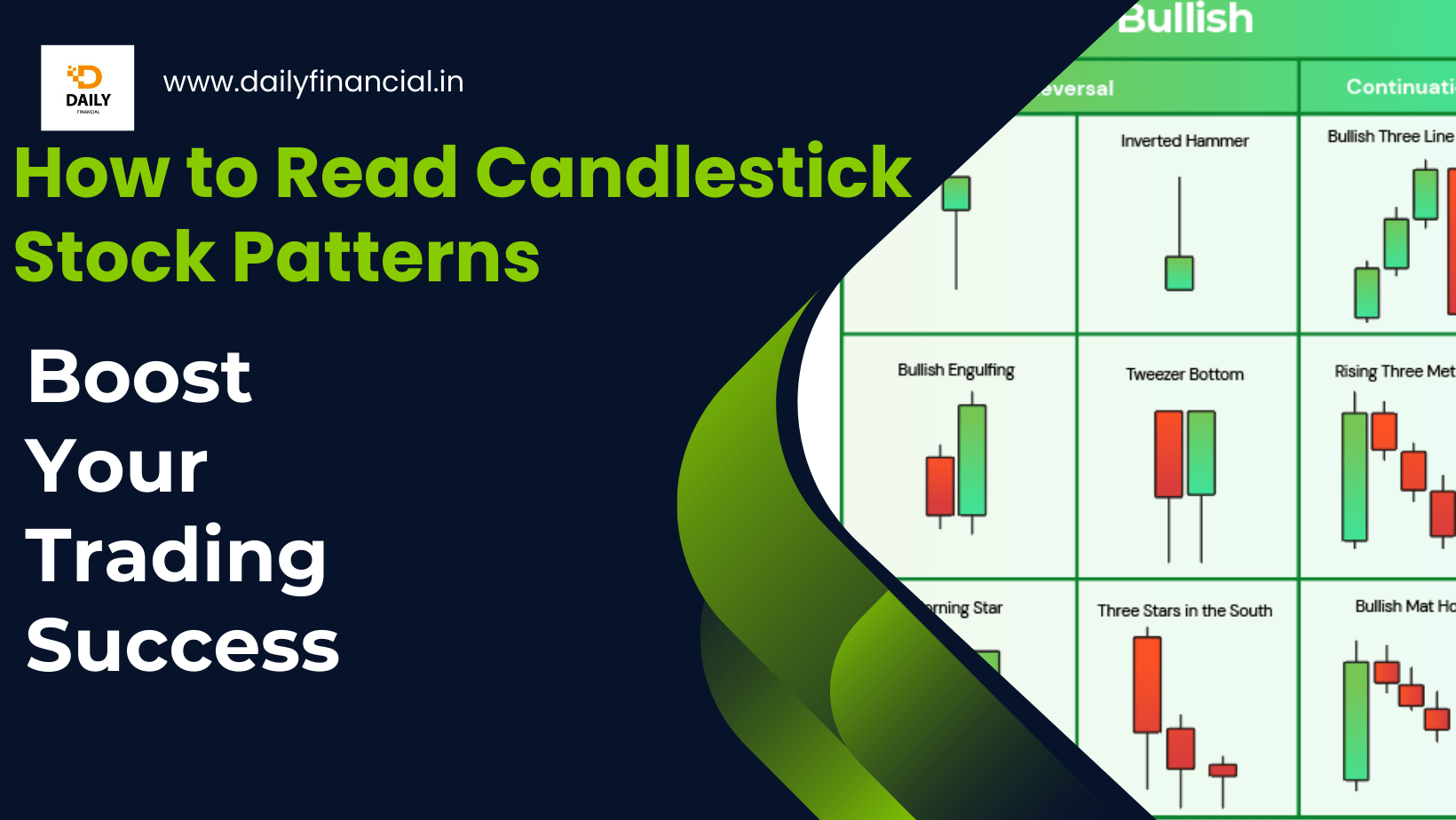

Understanding candlestick stock patterns is one of the key skills that can transform you from a novice trader to an expert in the stock market. These patterns provide insights into market sentiment, helping traders make informed decisions. In this guide, we will walk you through the essential candlestick patterns, how to interpret them, and how you can leverage them to boost your trading success.

What are Candlestick Patterns?

Candlestick patterns are graphical representations of price movements over a specific period. Each candlestick provides four pieces of information: the opening price, closing price, highest price, and lowest price of the asset during that time frame. Understanding these elements allows traders to interpret market behaviour and predict future price movements.

Why Candlestick Patterns Matter in Trading

Candlestick patterns are significant because they reveal market psychology. By understanding the dynamics between buyers and sellers, traders can predict potential reversals or continuations in trends. For those seeking success in stock trading, knowing how to read these patterns is critical for timely entry and exit points.

Anatomy of a Candlestick

Before diving into specific patterns, let’s break down the basic components of a candlestick:

- The Body: This is the rectangular area between the opening and closing prices. If the closing price is higher than the opening price, the body is typically green or white, indicating a bullish trend. If the closing price is lower, the body is red or black, signalling a bearish trend.

- The Wick (Shadow): These are the lines extending from the top and bottom of the body, representing the highest and lowest prices during the time frame.

- The Tail: Often referred to as the lower shadow, it represents the lowest price during the session.

Key Candlestick Patterns to Master

1. The Doji

A Doji forms when the opening and closing prices are nearly equal, resulting in a very small body. This pattern indicates indecision in the market, where neither buyers nor sellers are in control.

Types of Doji Candlesticks

- Neutral Doji: Neither bullish nor bearish; signals market indecision.

- Long-legged Doji: A sign that market participants are equally balanced in their buying and selling.

- Gravestone Doji: Typically bearish, signalling that sellers have taken control.

- Dragonfly Doji: Typically bullish, suggesting those buyers may soon dominate.

2. The Hammer and Hanging Man

- Hammer: This pattern features a small body with a long lower wick, indicating that although prices fell during the session, they recovered significantly by the close. It’s often a sign of a potential bullish reversal.

- Hanging Man: Visually similar to the hammer, but it occurs at the top of an upward trend and can signify a bearish reversal.

3. The Engulfing Pattern

- Bullish Engulfing: This pattern forms when a small bearish candlestick is followed by a larger bullish candlestick, “engulfing” it. This is a strong indication that bullish sentiment is taking over.

- Bearish Engulfing: The reverse of the bullish engulfing pattern, this occurs when a small bullish candlestick is followed by a larger bearish one. This signals that bears have taken control and a potential downward move is likely.

4. The Morning Star and Evening Star

- Morning Star: This is a three-candlestick pattern that signals a potential bullish reversal. It starts with a long bearish candlestick, followed by a small-bodied candlestick (indicating indecision), and finishes with a long bullish candlestick.

- Evening Star: The opposite of the morning star, the evening star signals a potential bearish reversal.

5. The Shooting Star

The Shooting Star pattern consists of a small body with a long upper wick, indicating that buyers pushed the price up during the session but couldn’t maintain control. This pattern suggests a potential bearish reversal.

6. The Three White Soldiers and Three Black Crows

- Three White Soldiers: This bullish pattern is made up of three consecutive long-bodied bullish candlesticks. It suggests that an upward trend is likely to continue.

- Three Black Crows: This bearish pattern involves three consecutive long-bodied bearish candlesticks, indicating that the market may continue to move downward.

How to Use Candlestick Patterns in Your Trading Strategy

To boost your trading success, knowing how to read candlestick patterns is essential, but it’s equally important to combine these insights with other indicators like volume, moving averages, and support and resistance levels. Here’s how you can integrate candlestick patterns into your strategy:

1. Confirm with Other Indicators

Candlestick patterns alone can sometimes give false signals. For more accuracy, confirm the pattern with other technical indicators like Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). For example, if you spot a Bullish Engulfing pattern, check the RSI to see if the asset is oversold for further confirmation.

2. Pay Attention to Market Context

The same pattern can mean different things in varying market conditions. For example, a Doji may signal indecision during a trending market, but during a consolidation phase, it could hint at a trend reversal. Always analyse patterns in the context of broader market conditions.

3. Manage Risk with Stop Losses

Patterns like the Shooting Star or Engulfing patterns can indicate reversals, but it’s essential to manage your risk. Set appropriate stop-loss levels to protect yourself in case the market moves against your trade. Place your stop-loss at a recent swing high or low to minimize potential losses.

4. Avoid Overtrading

Candlestick patterns are effective, but relying solely on them may lead to overtrading. Combine pattern analysis with a broader trading plan that includes fundamental analysis, overall market sentiment, and a defined risk-to-reward ratio.

How to Build a Trading Strategy Using Candlestick Patterns

To maximize the benefits of candlestick patterns, you need to integrate them into a comprehensive trading strategy. Here’s a step-by-step approach to doing that:

1. Define Your Trading Goals and Time Frame

The first step in building a successful trading strategy is to define your goals. Are you a day trader looking for quick profits, or a swing trader seeking to capture medium-term trends? Your goals will dictate which candlestick patterns and time frames to focus on. For day traders, shorter time frames like the 5-minute or 15-minute charts are most relevant. For swing traders, the daily and hourly charts provide more significant patterns to work with.

2. Identify Key Levels of Support and Resistance

Before analysing candlestick patterns, identify important support and resistance levels. These levels represent psychological barriers where price tends to reverse or consolidate. Patterns that form around these levels are often more reliable. For example, if a Bullish Hammer forms near a strong support level, it’s more likely to result in a reversal than if it forms in the middle of a trend.

3. Use Confirmation Indicators

Candlestick patterns are best used alongside other technical indicators to confirm their signals. Some of the most common confirmation tools include:

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions in the market. A bullish pattern combined with an RSI reading in oversold territory strengthens the likelihood of a reversal.

- Moving Averages: Moving averages smooth out price action and help identify trends. A pattern such as the Three White Soldiers forming above a rising 50-day moving average is a stronger signal than one forming below it.

- MACD (Moving Average Convergence Divergence): This indicator helps identify changes in momentum. For example, if a Bearish Engulfing pattern forms while the MACD is showing decreasing momentum, it increases the chances of a trend reversal.

4. Plan Your Entry and Exit Points

Once you’ve identified a reliable candlestick pattern and confirmed it with other indicators, it’s time to plan your entry and exit points. Here’s how to do it:

- Entry Point: The ideal entry point is usually at the open of the next candle after the pattern is complete. For example, if you’re trading a Bullish Engulfing pattern, enter the trade as soon as the next candle opens after the engulfing candle.

- Exit Point: Plan your exit based on previous resistance levels, technical indicators, or trailing stop-losses. For example, if you’re trading a Bearish Engulfing pattern, exit at the next major support level or once your take-profit target is hit.

5. Implement Stop-Losses to Minimize Risk

Risk management is crucial in any trading strategy. A stop-loss helps limit your losses if the trade doesn’t go as expected. Place your stop-loss just below the most recent low (in the case of a bullish pattern) or just above the most recent high (for a bearish pattern). For example, when trading a Shooting Star pattern, place a stop-loss just above the upper shadow to minimize potential losses if the price moves higher than anticipated.

6. Review and Adjust Your Strategy

Finally, regularly review your trading strategy to identify areas for improvement. Track your trades and analyse what worked and what didn’t. This will help you refine your approach, spot patterns more effectively, and improve your overall success rate.

Common Mistakes to Avoid When Using Candlestick Patterns

Even experienced traders can fall into traps when using candlestick patterns. Here are some mistakes to avoid:

1. Ignoring the Bigger Picture

While candlestick patterns offer excellent insights, don’t ignore the overall market trend. Trading against the larger trend based solely on candlestick signals can lead to losses. Ensure that your candlestick analysis aligns with the general market direction.

2. Over-relying on a Single Candlestick

Never base your trading decision on a single candlestick pattern without confirming it with other indicators or multiple time frames. Patterns can be misleading, especially in choppy markets where false signals are common.

3. Failing to Account for Market News

Candlestick patterns do not account for sudden news events that may drastically shift market sentiment. Always be aware of economic reports, earnings releases, or political events that could impact the stock you are trading.

Advanced Candlestick Patterns for Pro Traders

For traders who have mastered the basics, there are more advanced candlestick patterns that provide deeper insights into market dynamics. These patterns require a keen eye and a more nuanced understanding of market behaviour, but once understood, they can significantly improve trading strategies.

1. The Harami Pattern

The Harami pattern is a two-candlestick formation that signals a potential reversal. A Harami consists of a large candlestick followed by a smaller one that fits entirely within the body of the previous candle. It represents a weakening of the current trend and may indicate a reversal.

- Bullish Harami: This pattern occurs during a downtrend and signals a potential reversal to the upside. The second candlestick is a small bullish candle within the body of a larger bearish one.

- Bearish Harami: This pattern appears during an uptrend and signals a potential reversal to the downside. The second candlestick is a small bearish candle within a larger bullish one.

2. The Piercing Line and Dark Cloud Cover

These are two-candlestick patterns that signal potential reversals.

- Piercing Line: This bullish reversal pattern appears during a downtrend. The first candlestick is bearish, and the second is a bullish candle that closes above the midpoint of the first. This indicates a possible shift in sentiment from sellers to buyers.

- Dark Cloud Cover: The bearish counterpart to the Piercing Line, this pattern occurs during an uptrend. The first candle is bullish, and the second is a bearish candle that closes below the midpoint of the first. This is a sign that sellers are gaining control.

3. The Tweezer Tops and Tweezer Bottoms

Tweezer patterns consist of two candlesticks with matching highs or lows, signalling a potential reversal.

- Tweezer Tops: This pattern appears at the top of an uptrend and indicates that the market is struggling to push higher. It consists of two candles with similar highs, suggesting a potential bearish reversal.

- Tweezer Bottoms: This pattern appears at the bottom of a downtrend and indicates that the market is struggling to push lower. It consists of two candles with similar lows, suggesting a potential bullish reversal.

4. The Rising and Falling Three Methods

These patterns are continuation patterns that signal a temporary consolidation in an on-going trend before it resumes in the same direction.

- Rising Three Methods: This bullish continuation pattern consists of a long bullish candlestick followed by a series of smaller bearish candlesticks, which are then followed by another long bullish candlestick. It indicates that the market is consolidating before continuing higher.

- Falling Three Methods: The bearish counterpart to the Rising Three Methods, this pattern consists of a long bearish candlestick followed by smaller bullish candlesticks and then another long bearish candlestick. It suggests that the market is consolidating before moving lower.

5. The Abandoned Baby

The Abandoned Baby is a rare yet powerful reversal pattern. It consists of three candles: a large bullish or bearish candle, followed by a Doji (a candle with no body), and then a large candle in the opposite direction. This pattern indicates a sharp change in market sentiment, with the Doji representing indecision, and the third candle confirming the reversal.

- Bullish Abandoned Baby: This pattern appears after a downtrend and signals a reversal to the upside.

- Bearish Abandoned Baby: This pattern appears after an uptrend and signals a reversal to the downside.

Combining Candlestick Patterns with Volume

While candlestick patterns are incredibly useful, their accuracy increases when combined with other indicators, especially volume. Volume refers to the number of shares or contracts traded during a specific period and are often considered a leading indicator of price movement.

Why Volume Matters

Volume can confirm the strength of a candlestick pattern. For instance, if you spot a Bullish Engulfing pattern, high volume during the second candle confirms the strength of the buyers. Conversely, if a Bearish Engulfing pattern forms but the volume is low, the signal may be weak, and the reversal might not follow through.

Using Volume to Confirm Patterns

- High Volume with Reversal Patterns: If a reversal pattern such as a Morning Star or Shooting Star forms on high volume, it indicates a stronger signal. This shows that market participants are fully committing to the new direction.

- Low Volume with Continuation Patterns: For continuation patterns such as the Rising Three Methods, low volume during the consolidation phase followed by high volume on the breakout confirms that the market is preparing to continue the trend.

Time Frames and Candlestick Patterns

Different time frames can impact how candlestick patterns are interpreted. A pattern that forms on a daily chart might signal a longer-term trend, while the same pattern on a 5-minute chart may indicate a short-term trade opportunity. Here’s how you can approach candlestick patterns across different time frames:

1. Short-Term Trading

For day traders or scalpers, candlestick patterns on shorter time frames (1-minute, 5-minute, 15-minute charts) can be used to capture quick moves. In this case, patterns such as Doji, Hammer, or Shooting Star may signal brief opportunities to enter or exit trades.

2. Swing Trading

For swing traders, who hold positions for days or weeks, candlestick patterns on the hourly or daily charts are more relevant. Patterns like the Engulfing or Three White Soldiers on these time frames can signal shifts in medium-term trends.

3. Long-Term Trading

For position traders or investors, who hold trades for months or years, patterns on the daily or weekly charts are most reliable. Reversal patterns such as the Morning Star or Bearish Engulfing on these time frames may signal a change in long-term market sentiment.

Using Candlestick Patterns in Conjunction with Support and Resistance

Support and resistance levels are critical tools in technical analysis. Combining candlestick patterns with these levels can provide even stronger trading signals.

1. Support and Candlestick Reversals

When a bullish reversal pattern, such as a Hammer or Bullish Engulfing, forms near a support level, it provides a more reliable signal that the price may bounce higher.

2. Resistance and Candlestick Reversals

Similarly, when a bearish reversal pattern, such as a Shooting Star or Bearish Engulfing, forms near a resistance level, it suggests the price may reverse lower.

3. Breakout Trades

Candlestick patterns can also signal potential breakouts. For example, if the price breaks through a resistance level with a Three White Soldiers pattern, it indicates strong bullish momentum and a likely continuation of the trend.

Common Pitfalls When Using Candlestick Patterns

Even the most experienced traders can make mistakes when interpreting candlestick patterns. While these patterns are powerful tools, they aren’t fool proof. Here are some common pitfalls traders should be aware of when using candlestick patterns in their strategies:

1. Relying Solely on Candlestick Patterns

While candlestick patterns provide valuable insights into market behaviour, they should never be used in isolation. Traders who rely solely on these patterns may experience false signals, especially in volatile markets. To avoid this, always combine candlestick patterns with other technical indicators such as moving averages, Bollinger Bands, or Fibonacci retracements. For example, spotting a Bullish Engulfing pattern is great, but confirming it with an upward moving average crossover strengthens the signal.

2. Ignoring Market Context

Candlestick patterns must be interpreted within the larger market context. A bearish reversal pattern like the Shooting Star may not have the same significance in a strong bull market. The broader trend should always be considered when analysing candlestick patterns. Look at other factors such as economic conditions, earnings reports, or major news events to get a complete picture of the market.

3. Overtrading Based on Candlestick Patterns

Some traders make the mistake of overtrading after spotting a candlestick pattern. While the formation of a pattern can signal a potential trading opportunity, not every pattern results in a successful trade. Overtrading can lead to unnecessary risk and increased transaction costs. It’s essential to be selective and only trade when the pattern is part of a larger strategy.

4. Misinterpreting Candlestick Size and Proportions

The size and proportions of candlesticks matter. A small-bodied Hammer with a long lower wick may indicate a possible reversal, but if the body is too small or the wick too short, the signal may be weak. Similarly, patterns such as the Engulfing pattern rely on the proportions of the candles for strength. A weak Bullish Engulfing with a small bullish candle may not provide enough confidence to initiate a trade. Always assess the size and proportions before making a decision.

5. Not Using Proper Risk Management

Even with clear candlestick patterns, trading is never guaranteed. That’s why proper risk management is crucial. Always set stop-losses to protect against unexpected market movements. For example, if you’re trading a Bearish Engulfing pattern, place a stop-loss slightly above the high of the engulfed bullish candle. This limits your loss in case the market reverses unexpectedly.

6. Overlooking the Importance of Time Frames

Different time frames tell different stories. A candlestick pattern on a 15-minute chart might signal a short-term trading opportunity, while the same pattern on a daily chart may indicate a more significant trend shift. Traders who focus only on short-term patterns without considering higher time frames can miss the bigger picture. It’s essential to analyse multiple time frames to confirm patterns and spot potential trends.

7. Trading Every Candlestick Pattern

Not every candlestick pattern is worth trading. Beginners, in particular, may get excited by spotting patterns such as the Doji or Engulfing pattern and jump into trades prematurely. It’s important to recognize that not all patterns are created equal. Look for patterns that form near key support and resistance levels or that occur in conjunction with other indicators. Additionally, consider the volume accompanying the pattern. Higher volume gives more weight to the pattern’s significance.

Conclusion: Becoming a Master of Candlestick Stock Patterns

Mastering candlestick patterns is an invaluable skill for any trader. By understanding the psychology behind each pattern and combining them with other technical tools, you can significantly enhance your trading performance. Whether you’re a beginner or an experienced trader, continuous learning and practice will help you become more proficient in identifying and executing trades based on candlestick stock patterns.

Frequently Asked Questions

- What are candlestick patterns in stock trading?

Candlestick patterns are visual representations of price movements over a specific time period. They provide traders with insights into market sentiment and potential future price direction. - How do candlestick patterns help in trading?

Candlestick patterns help traders identify potential trend reversals or continuations, allowing them to make informed decisions on buying, selling, or holding stocks. - What is the difference between a bullish and bearish candlestick pattern?

A bullish pattern indicates a potential upward price movement, while a bearish pattern signals a potential downward price movement. - Can candlestick patterns be used for short-term and long-term trading?

Yes, candlestick patterns can be used in both short-term (intraday) and long-term (swing or position) trading. Their significance depends on the time frame you are analysing. - What is a Doji candlestick, and what does it indicate?

A Doji is a candlestick with little to no body, indicating indecision in the market. It suggests a potential reversal or a pause in the current trend. - Which is the most reliable candlestick pattern for reversals?

Patterns like the Engulfing, Hammer, and Shooting Star are often considered reliable indicators of potential trend reversals. - Should I combine candlestick patterns with other indicators?

Yes, combining candlestick patterns with other technical indicators, such as moving averages or volume, improves the accuracy of the signals and helps avoid false patterns. - How important is volume in confirming candlestick patterns?

Volume is critical in confirming the strength of a candlestick pattern. Higher volume during a pattern indicates a stronger likelihood of a valid signal. - Can candlestick patterns predict 100% accurate outcomes?

No, candlestick patterns do not guarantee price movements but provide probabilities based on past behaviour. It’s essential to use them in conjunction with risk management strategies. - How can I improve my accuracy in reading candlestick patterns?

To improve accuracy, practice regularly, use multiple time frames for confirmation, and incorporate other technical analysis tools to enhance your decision-making.

-

Diesel Prices Surge in India: Hormuz Halt Puts Spotlight on Reserves and Russian Supplies

-

Indian Stock Market Trends: Volatility Signals Big Opportunities Ahead?

-

MacBook Neo A18 Pro Processor Benchmarks: How It Handles Apple Intelligence and Multitasking on 8GB RAM

-

Iran-Israel Conflict Sent Gold to ₹1.71 Lakh/10g — Here’s What Happens to the Price If Tensions Ease

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!