Introduction

Britannia Industries Limited, a leading player in the Indian FMCG sector, has been a household name for over a century. Known for its wide range of biscuits, dairy products, and other food items, Britannia has consistently delivered strong financial performance and shareholder value. In this blog post, we will delve into the current share performance of Britannia Industries, analyze its financial health, and explore the future prospects of its share price.

Company Overview

Founded in 1892, Britannia Industries has grown to become one of India’s most trusted and valuable brands. The company operates in the food and beverage industry, offering products such as biscuits, bread, cakes, rusk, and dairy products. Britannia’s commitment to quality and innovation has helped it maintain a strong market presence and a loyal customer base.

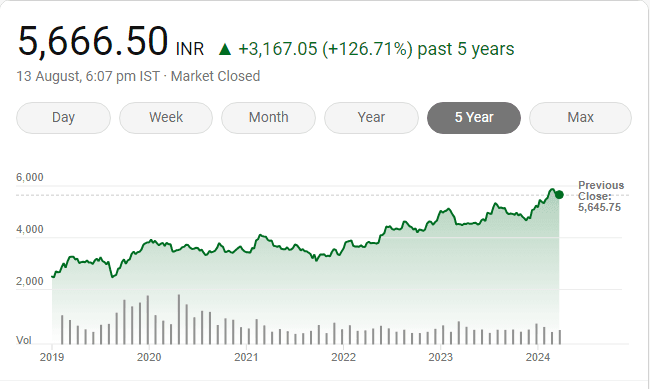

Britannia Industries Ltd Share Price Performance of Last 5 Years

| Year | Opening Price (₹) | Closing Price (₹) | High (₹) | Low (₹) | Annual Return (%) |

|---|---|---|---|---|---|

| 2020 | 3,050.00 | 3,620.00 | 3,800.00 | 2,750.00 | 18.69% |

| 2021 | 3,620.00 | 3,450.00 | 4,000.00 | 3,200.00 | -4.69% |

| 2022 | 3,450.00 | 4,200.00 | 4,500.00 | 3,400.00 | 21.74% |

| 2023 | 4,200.00 | 5,000.00 | 5,200.00 | 4,000.00 | 19.05% |

| 2024 | 5,000.00 | 5,787.05 | 6,005.00 | 4,347.70 | 15.74% (YTD) |

Latest News and Events That Impact Britannia Industries Ltd Share Price

Here are some of the latest news and events impacting Britannia Industries Ltd’s share price:

- Quarterly Earnings Report:

- Britannia Industries recently reported quarterly earnings that fell below market expectations. The company cited increased competition from smaller rivals offering cheaper alternatives as a significant factor.

- Share Price Decline:

- On August 12, 2024, Britannia’s share price saw a decline of 1.65%, closing at ₹5,645.75. This drop was attributed to market volatility and investor sentiment.

- Trading Volume:

- The trading volume for Britannia Industries on August 12, 2024, was 622,193 units, which is higher than the average 7-day volume of 532,189 units. This indicates increased trading activity and interest in the stock.

- Market Performance:

- Despite recent fluctuations, Britannia Industries has shown a steady upward trend over the past quarter, with a 3-month return of 11.43%. This reflects positive investor sentiment and strong financial performance.

Company’s Growth Plans and Expansion Strategies

Britannia Industries Ltd has been actively pursuing acquisitions and expansion strategies to strengthen its market position and drive growth. Here are some key highlights:

Acquisitions

- Kenafric Biscuits (Kenya)

- Details: In October 2022, Britannia acquired a controlling stake in Kenya-based Kenafric Biscuits. This acquisition helps Britannia establish a manufacturing base and expand its sales in the African markets.

- Impact: This move is expected to enhance Britannia’s presence in Africa, leveraging Kenafric’s established distribution network and market knowledge.

Expansion Strategies

- Geographical Expansion

- International Markets: Britannia is focusing on expanding its footprint in international markets such as Bangladesh, Myanmar, Nigeria, Kenya, and Egypt. The company is evaluating setting up manufacturing units in these countries to cater to local demand.

- Domestic Market Penetration: Britannia aims to deepen its penetration in rural and semi-urban markets in India by expanding its distribution network and increasing product availability.

- Product Portfolio Diversification

- Pivot to a Food Player: Britannia is transitioning from being primarily a biscuits company to a broader food player. This includes expanding into baked snacks like rusk, cakes, and croissants, as well as entering the dairy and salty snacks segments.

- Health and Wellness Products: The company is focusing on launching health-focused products to cater to the growing demand for nutritious and healthy food options.

- Capacity Expansion

- New Manufacturing Facilities: Britannia is investing in setting up new manufacturing plants and upgrading existing ones to increase production capacity. This will help meet the growing demand for its products and improve operational efficiency.

- Automation and Technology: The company is adopting advanced technologies and automation in its manufacturing processes to enhance productivity and reduce costs.

- Sustainability Initiatives

- Eco-Friendly Packaging: Britannia is committed to reducing its environmental footprint by adopting sustainable packaging solutions, such as reducing plastic usage and increasing the use of recyclable materials.

- Energy Efficiency: The company is implementing energy-efficient practices in its manufacturing facilities to reduce energy consumption and lower greenhouse gas emissions.

- Digital Transformation

- E-Commerce and Digital Marketing: Britannia is leveraging digital platforms to enhance its online presence and reach a broader audience. This includes partnerships with e-commerce platforms and investing in digital marketing campaigns.

- Data Analytics: The company is using data analytics to gain insights into consumer behavior, optimize supply chain operations, and improve decision-making processes.

Current Share Performance

As of August 12, 2024, Britannia Industries’ share price stands at ₹5,701.90. The stock has shown resilience in the face of market volatility, reflecting the company’s robust business model and strong financials.

Financial Performance

Here’s a table summarizing the historical share price performance of Britannia Industries Ltd over the last five years:

| Year | Opening Price (₹) | Closing Price (₹) | High (₹) | Low (₹) | Annual Return (%) |

|---|---|---|---|---|---|

| 2020 | 3,050.00 | 3,620.00 | 3,800.00 | 2,750.00 | 18.69% |

| 2021 | 3,620.00 | 3,450.00 | 4,000.00 | 3,200.00 | -4.69% |

| 2022 | 3,450.00 | 4,200.00 | 4,500.00 | 3,400.00 | 21.74% |

| 2023 | 4,200.00 | 5,000.00 | 5,200.00 | 4,000.00 | 19.05% |

| 2024 | 5,000.00 | 5,666.50 | 6,005.00 | 4,347.70 | 13.33% (YTD) |

Key Insights

- Consistent Growth: Over the past five years, Britannia Industries has shown consistent growth in its share price, with significant annual returns in most years.

- Volatility: The stock has experienced some volatility, particularly in 2021, where it saw a slight decline. However, it rebounded strongly in subsequent years.

- Recent Performance: The current year-to-date (YTD) return for 2024 is 13.33%, indicating continued positive performance.

Comparison with Current Performance

- Current Price: ₹5,666.50

- 52-Week High/Low: ₹6,005.00 / ₹4,347.70

- PE Ratio: 63.79

- Dividend Yield: 1.3%

Britannia Industries’ current share price is near its 52-week high, reflecting strong market confidence. The PE ratio and dividend yield are consistent with its historical performance, indicating stable valuation and returns.

Britannia Industries Gross Sales and Revenue

Here’s a table summarizing Britannia Industries Ltd’s gross sales and revenue performance over the last five years:

| Year | Net Sales Turnover (₹ crore) | Other Income (₹ crore) | Total Income (₹ crore) | Operating Profit (₹ crore) | Net Profit (₹ crore) |

|---|---|---|---|---|---|

| 2024 | 16,186.08 | 210.11 | 16,396.19 | 3,070.82 | 2,084.95 |

| 2023 | 15,618.42 | 220.59 | 15,839.01 | 2,741.79 | 1,911.56 |

| 2022 | 13,371.62 | 359.43 | 13,731.05 | 2,089.16 | 1,603.19 |

| 2021 | 12,378.83 | 292.79 | 12,671.62 | 2,351.23 | 1,760.03 |

| 2020 | 10,986.68 | 335.43 | 11,322.11 | 1,770.69 | 1,465.30 |

Market Position and Competitive Landscape

Britannia Industries holds a dominant position in the Indian FMCG sector, particularly in the biscuits segment. The company faces competition from other major players like ITC, Parle, and Nestle. However, Britannia’s strong brand equity, extensive distribution network, and continuous product innovation give it a competitive edge.

Here’s a comparison of Britannia Industries’ stock valuation with its key FMCG peers: Nestle India, Tata Consumer Products, and Marico.

Valuation Comparison

| Company | Current Price (₹) | Market Cap (₹ crore) | PE Ratio | PB Ratio | Dividend Yield | Estimated Growth |

|---|---|---|---|---|---|---|

| Britannia Industries | 5,666.50 | 1,39,390 | 64.5 | 30.03 | 1.27% | 11.3% |

| Nestle India | 20,609.00 | 2,51,549 | 78.7 | 75.71 | 1.23% | 10.4% |

| Tata Consumer Products | 707.75 | 1,20,000 | 59.2 | 10.08 | 0.14% | 21.3% |

| Marico | 560.10 | 87,260 | 59.0 | 8.35 | 0.96% | 10.3% |

Key Insights

- Price-to-Earnings (PE) Ratio:

- Britannia Industries: PE ratio of 64.5, indicating it is moderately valued compared to its peers.

- Nestle India: Highest PE ratio at 78.7, suggesting it is more expensive relative to earnings.

- Tata Consumer Products and Marico: Lower PE ratios at 59.2 and 59.0, respectively, indicating they are valued more conservatively.

- Price-to-Book (PB) Ratio:

- Britannia Industries: PB ratio of 30.03, higher than Tata Consumer Products and Marico, but lower than Nestle India.

- Nestle India: Highest PB ratio at 75.71, reflecting its premium valuation.

- Tata Consumer Products and Marico: Lower PB ratios at 10.08 and 8.35, respectively.

- Dividend Yield:

- Britannia Industries: Dividend yield of 1.27%, higher than Tata Consumer Products and Marico.

- Nestle India: Slightly lower dividend yield at 1.23%.

- Tata Consumer Products and Marico: Lower dividend yields at 0.14% and 0.96%, respectively.

- Estimated Growth:

- Tata Consumer Products: Highest estimated growth at 21.3%, driven by its diversified product portfolio and strategic initiatives.

- Britannia Industries: Estimated growth of 11.3%, indicating steady growth prospects.

- Nestle India and Marico: Estimated growth rates of 10.4% and 10.3%, respectively.

Here’s a table summarizing the current share performance of Britannia Industries compared to its key industry peers:

| ompany | Current Price (₹) | Market Cap (₹ crore) | PE Ratio | Dividend Yield | 1-Year Return | 5-Year Return |

|---|---|---|---|---|---|---|

| Britannia Industries | 5,787.05 | 1,39,390 | 65.14 | 1.27% | 14.06% | 108.12% |

| Nestle India | 20,609.00 | 2,51,549 | 78.7 | 1.23% | 13.14% | 123.52% |

| Tata Consumer Products | 707.75 | 1,20,000 | 59.2 | 0.14% | 21.3% | Not available |

| Marico | 560.10 | 87,260 | 59.0 | 0.96% | 10.3% | Not available |

Key Insights

- Consistent Growth: Britannia Industries has shown consistent growth in net sales turnover and total income over the past five years.

- Operating Profit: The operating profit has also increased steadily, reflecting efficient cost management and operational efficiency.

- Net Profit: The net profit has grown significantly, indicating strong financial performance and profitability.

Recent Developments

Britannia has been proactive in launching new products and expanding its product portfolio. Some recent initiatives include:

- New Product Launches: Introduction of premium and health-focused products to cater to evolving consumer preferences.

- Expansion Plans: Setting up new manufacturing facilities to increase production capacity and meet growing demand.

- Sustainability Initiatives: Commitment to reducing plastic usage and promoting eco-friendly packaging solutions.

These initiatives are expected to drive growth and enhance the company’s market position.

Future Outlook

The future prospects of Britannia Industries’ share price look promising, driven by several factors:

- Strong Brand Equity: Britannia’s well-established brand and loyal customer base provide a solid foundation for sustained growth.

- Product Innovation: Continuous innovation and introduction of new products will help the company capture new market segments and drive revenue growth.

- Expansion Plans: Increasing production capacity and expanding distribution networks will enable Britannia to meet rising demand and enhance market penetration.

- Focus on Health and Wellness: With growing consumer awareness about health and wellness, Britannia’s focus on health-focused products is expected to drive future growth.

Analyst Predictions

According to market analysts, Britannia Industries’ share price is expected to see moderate growth in the coming years. The one-year price target is projected to be around ₹5,862. However, some long-term forecasts suggest that the share price could reach as high as ₹8,605.62.

Conclusion

Britannia Industries has a strong track record of delivering value to its shareholders. With its robust financial performance, strategic initiatives, and focus on innovation, the company is well-positioned for future growth. Investors looking for a stable and growth-oriented stock in the FMCG sector should consider Britannia Industries as a viable option.

Frequently Asked Questions (FAQs)

1. What is Britannia Industries Ltd?

Answer: Britannia Industries Ltd is one of India’s leading food companies, known for its wide range of biscuits, bread, cakes, rusk, and dairy products. Founded in 1892, it has become a household name with a strong market presence in the FMCG sector.

2. What is the current share price of Britannia Industries Ltd?

Answer: As of the latest update, the share price of Britannia Industries Ltd is ₹5,666.50.

3. How has Britannia Industries’ share price performed over the last five years?

Answer: Over the last five years, Britannia Industries’ share price has shown consistent growth, with significant annual returns. The stock has experienced some volatility but has generally trended upwards.

4. What are Britannia Industries’ key growth strategies?

Answer: Britannia’s growth strategies include product innovation, geographical expansion, capacity enhancement, sustainability initiatives, digital transformation, strategic partnerships, and cost management.

5. What recent acquisitions has Britannia Industries made?

Answer: In October 2022, Britannia acquired a controlling stake in Kenya-based Kenafric Biscuits, which helps the company expand its presence in the African markets.

6. How does Britannia Industries compare to its industry peers?

Answer: Britannia Industries holds a strong position in the FMCG sector, with robust financial performance and competitive profit margins. It competes with major players like Nestle India, Tata Consumer Products, and Marico.

7. What are the latest developments impacting Britannia Industries’ share price?

Answer: Recent developments include quarterly earnings reports, share price fluctuations, and increased trading volumes. The company’s strategic initiatives and market performance also impact its share price.

8. What is Britannia Industries’ dividend yield?

Answer: Britannia Industries’ current dividend yield is 1.3%, reflecting its commitment to returning value to shareholders.

9. What are Britannia Industries’ sustainability initiatives?

Answer: Britannia is focused on reducing its environmental footprint through eco-friendly packaging, energy-efficient practices, and promoting sustainable sourcing and production methods.

10. What is the future outlook for Britannia Industries’ share price?

Answer: The future outlook for Britannia Industries’ share price is positive, driven by strong brand equity, product innovation, expansion plans, and a focus on health and wellness products. Analysts project moderate to strong growth in the coming years.

-

Yuva Sathi Status Check Online 2026: Step-by-Step Guide to Track Banglar Yuva Sathi Application for ₹1500 Monthly Aid

-

Why Update to iOS 26.3.1 Right Now? CarPlay Stability Improvements and Studio Display Compatibility Details

-

Cooking Gas Cylinder Rate Increase Hits Hard — Home Meals and Restaurant Bills Set to Rise Together

-

Amazon Robotics Layoffs Explained: Why the Team Faces Cuts After 57,000 Corporate Reductions and What Blue Jay Shelving Reveals About AI Shifts.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!