The introduction of the new tax regime in India has brought about significant changes in the way taxpayers can claim deductions. While many traditional deductions have been removed, there are still several key deductions that taxpayers can continue to avail. This blog post will explore these deductions in detail, providing you with the information you need to optimize your tax savings under the new regime.

Understanding the New Tax Regime

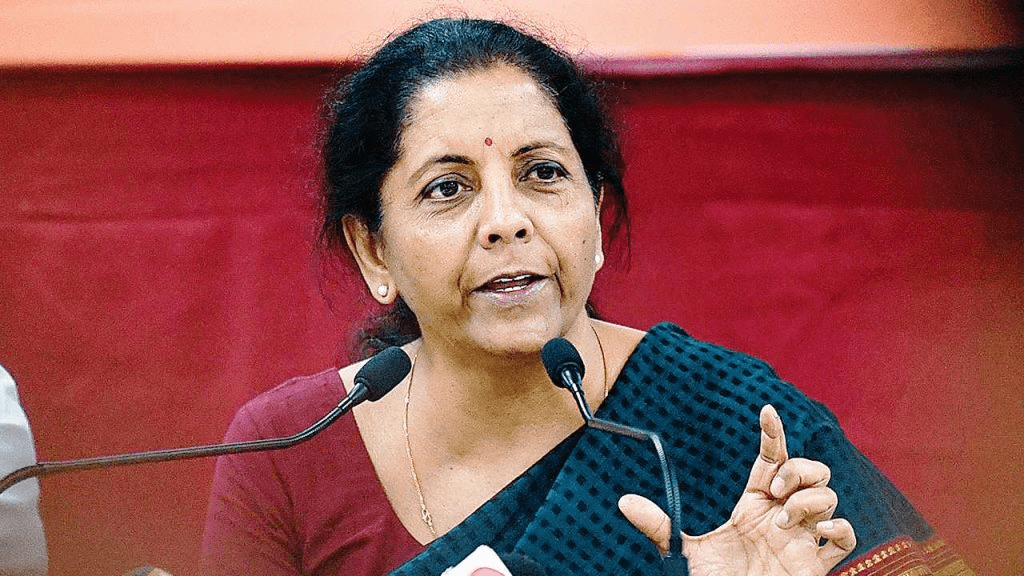

The new tax regime, introduced in the Union Budget 2020, offers lower tax rates but removes most of the exemptions and deductions available under the old regime. Taxpayers now have the option to choose between the old regime with higher tax rates and more deductions, or the new regime with lower tax rates and fewer deductions.

Recent Changes in Tax Laws

The Income Tax Bill 2025 has introduced several updates aimed at simplifying the tax system and making it more efficient. Here are some of the key changes:

- Shift from Assessment Year to Tax Year: The new bill replaces the traditional “assessment year” terminology with “tax year,” aligning the tax process with the financial year and streamlining compliance.

- Simplification of Tax Residency Rules: The rules for determining tax residency have been simplified, making it easier for individuals to understand their tax obligations.

- No New Taxes Introduced: The new bill does not introduce any new taxes but focuses on simplifying the language and structure of the existing tax laws.

- Comprehensive Overhaul: The new bill is a comprehensive document with 536 sections and 16 schedules, compared to the existing Income Tax Act with 298 sections and 14 schedules.

- Ease in TDS Compliance: All TDS-related sections have been consolidated under a single clause with simplified tables for easier understanding.

Key Deductions Available in the New Tax Regime

Under the new tax regime, salaried individuals can still claim a standard deduction of ₹50,000. This deduction is automatically applied and does not require any documentation.

2. Employer’s Contribution to NPS (Section 80CCD(2))

Employees can claim a deduction for their employer’s contribution to the National Pension System (NPS) under Section 80CCD(2). This deduction is over and above the ₹1.5 lakh limit under Section 80C and is capped at 10% of the employee’s salary.

3. Interest on Home Loan for Let-Out Property (Section 24(b))

Interest paid on a home loan for a let-out property can be claimed as a deduction under Section 24(b). There is no upper limit for this deduction, making it a significant benefit for property investors.

4. Deduction for Additional Employee Cost (Section 80JJAA)

Businesses can claim a deduction for the additional employee cost incurred during the financial year under Section 80JJAA. This deduction is available for three consecutive years and is aimed at encouraging employment generation.

5. Deduction for Donations to Political Parties (Section 80GGC)

Taxpayers can claim a deduction for donations made to political parties under Section 80GGC. This deduction is available to both individuals and companies and is aimed at promoting political contributions.

Rebates in the New Tax Regime

1. Rebate under Section 87A

One of the significant benefits under the new tax regime is the rebate available under Section 87A. In the Budget 2025, the income tax rebate limit was increased from ₹7 lakh to ₹12 lakh. This means that resident individuals with a total income of up to ₹12 lakh will not have to pay any income tax.

2. Rebate for Senior Citizens

Senior citizens (aged 60 years and above) and super senior citizens (aged 80 years and above) continue to enjoy higher exemption limits. For senior citizens, the exemption limit is ₹3 lakh, and for super senior citizens, it is ₹5 lakh.

New Tax Regime and Section 80C

In the new tax regime, taxpayers cannot claim deductions under Section 80C. The new regime offers lower tax rates but removes most of the exemptions and deductions available under the old regime, including those under Section 80C. This means that if you opt for the new tax regime, you will not be able to claim the ₹1.5 lakh deduction for investments and expenditures listed under Section 80C.

Recent Changes in Tax Laws

The Income Tax Bill 2025 has introduced several updates aimed at simplifying the tax system and making it more efficient. One of the key changes is the relocation of Section 80C deductions to Clause 123 in the new bill. This reorganization aims to simplify comprehension and observance of the norms by taxpayers. However, the new tax regime still does not allow for these deductions.

How to Optimize Your Tax Savings

To make the most of the available deductions and rebates under the new tax regime, it is essential to plan your finances strategically. Here are some tips to help you optimize your tax savings:

- Evaluate Both Regimes: Before making a decision, compare the tax liability under both the old and new regimes. Use online calculators to estimate your tax savings.

- Maximize NPS Contributions: Take advantage of the additional deduction available for employer contributions to NPS.

- Invest in Let-Out Properties: If you have the means, consider investing in let-out properties to benefit from the unlimited interest deduction under Section 24(b).

- Encourage Employment: If you run a business, focus on generating employment to claim the deduction under Section 80JJAA.

- Make Political Donations: Consider making donations to political parties to avail the deduction under Section 80GGC.

- Utilize Rebates: Ensure you are aware of and utilize the available rebates, especially the rebate under Section 87A for incomes up to ₹12 lakh.

The new tax regime offers several opportunities for taxpayers to optimize their tax savings through strategic planning and investment. By understanding and leveraging the available deductions and rebates, you can reduce your tax liability and make the most of the new regime. Stay informed and consult with a tax professional to ensure you are taking full advantage of all the benefits available to you.

While the new tax regime offers lower tax rates, it does not allow for Section 80C deductions. Taxpayers need to carefully evaluate their financial situation and tax liability under both regimes before making a decision. If you have significant investments and expenditures eligible for Section 80C deductions, you may find the old regime more beneficial. Always consult with a tax professional to ensure you are making the most informed decision.

-

Which Bank Gives the Cheapest Personal Loan in February 2026? Here’s What 10 Lenders Are Actually Offering

Kotak is offering 9.98%. SBI is at 10.05%. But most Indians are still paying 18%+ on personal loans

-

IDFC First Bank Chandigarh Branch Fraud: How Rs 590 Crore Went Missing From Haryana Government Accounts

A routine account closure request exposed a Rs 590 crore black hole inside IDFC First Bank’s Chandigarh branch

-

YES Bank Aims for 1% ROA by FY26: Is India’s Most Dramatic Banking Comeback Finally Complete?

YES Bank was frozen overnight in 2020 — depositors locked out, futures uncertain. Now, its CFO is quietly