8 years? Delhi HC explodes at IT Dept for withholding Rs 5.37 Cr from Microsoft—’shocking negligence!’ Personal...

TAX

GSTIN Suspended Overnight? Your Business is Paralyzed! Discover the shocking 2025 AI traps killing SMEs, secret 15-min...

PAN PANIC Jan 1, 2026: Your salary TDS DOUBLES to 20%, investments FREEZE, refunds VANISH if unlinked!...

GST Deadline Ticking: Dec 31 Trap or Relief? Tax pros rage over GSTR-9/9C chaos—new rules, portal crashes,...

Gold’s 20% surge beats stocks, but hidden taxes devour 30% gains—unless you unlock SGB’s tax-FREE maturity, 54F...

Discover the hidden reason why one wrong GST number could drain your business overnight! Learn the step-by-step...

Did you know one GSTR-1 glitch silently drains ₹50K+ monthly from your cash flow—without GST notices? Uncover...

India’s silent tax hunter is live: AI tracks ₹10L swipes, ₹30L homes, & luxury sprees of ITR...

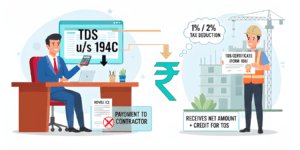

Shocking TDS Trap: Unlinked PAN turns ₹5L contractor bill into ₹1L tax bomb under 194C—yet CBDT’s secret...

Did you know one PAN glitch under TDS 194C can spike your 2% deduction to 20%—silently blocking...