You have spent months planning your dream trip to the serene backwaters of Kerala or the vibrant streets of Rajasthan. Flights are booked, hotels reserved, and your itinerary is packed with cultural experiences. But then, life throws a curveball—a sudden work emergency, a family issue, or even just a change of heart. Your heart sinks as you realize your non-refundable bookings might go to waste. Or will they? Enter Cancel For Any Reason (CFAR) travel insurance—a game-changer for Indian travellers seeking flexibility and peace of mind in an unpredictable world.

In this comprehensive guide, we’ll unravel the mystery of CFAR travel insurance, explore its benefits, and reveal why it’s a must-have for your next adventure. Packed with the latest data and insights, this blog post will keep you hooked, spark your curiosity, and equip you with everything you need to make an informed decision. Let’s dive into the world of CFAR and discover how it can transform your travel experience!

What is CFAR Travel Insurance?

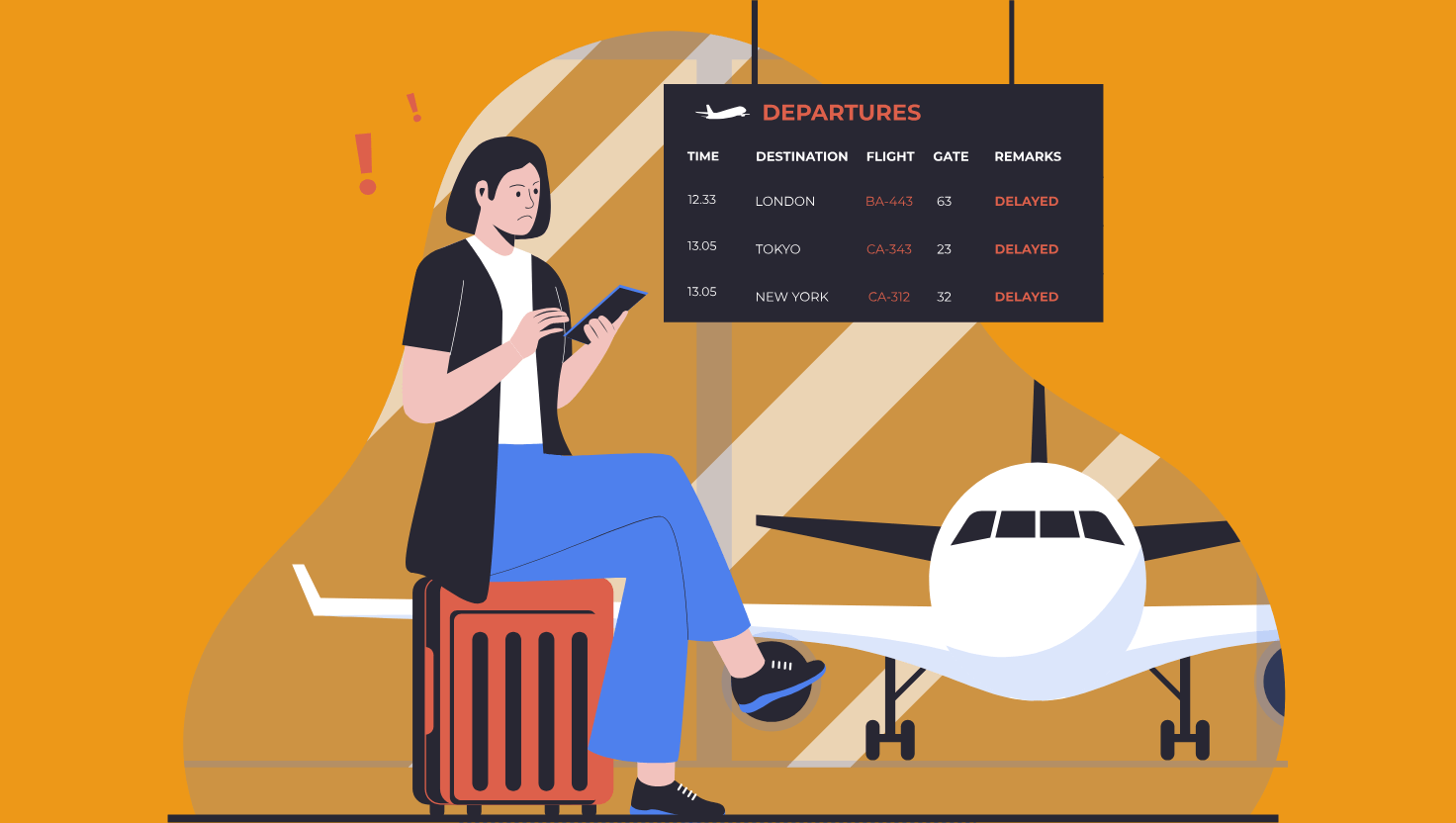

Cancel For Any Reason (CFAR) travel insurance is not your average travel insurance policy. While standard travel insurance covers specific scenarios like illness, natural disasters, or flight cancellations due to airline issues, CFAR takes flexibility to a whole new level. It allows you to cancel your trip for any reason—yes, any—and still recover a portion of your prepaid, non-refundable expenses. Whether it’s a sudden change in plans, a personal emergency, or simply a gut feeling that the trip isn’t right, CFAR has your back.

Available as an optional add-on to comprehensive travel insurance plans, CFAR typically reimburses 50-80% of your non-refundable trip costs, depending on the policy. However, it comes with specific eligibility requirements, such as purchasing the coverage within 14-21 days of your initial trip deposit and cancelling at least 48-72 hours before departure.

For Indian travellers, CFAR is especially appealing given the unpredictability of travel in today’s world. From sudden lockdowns to monsoon-related disruptions, CFAR offers a safety net that standard policies can’t match.

Curious about how it works and why it’s worth the extra cost? Keep reading to uncover the secrets of CFAR!

Why CFAR Travel Insurance is a Game-Changer for Travellers

Travel is an integral part of Indian culture, whether it’s exploring domestic gems like Goa’s beaches or international destinations like Dubai or Bali. But with travel comes uncertainty, and that’s where CFAR shines. Here’s why you shouldn’t ignore this powerful travel insurance benefit:

- Unmatched Flexibility for Any Reason

Unlike traditional travel insurance, which restricts cancellations to specific “covered reasons” like medical emergencies or natural disasters, CFAR lets you cancel for any reason. Changed your mind about that trip to the Andamans? Got a last-minute work commitment in Mumbai? Worried about political unrest at your international destination? CFAR doesn’t ask for explanations—it simply reimburses you, typically up to 75% of your non-refundable expenses.

For Indian travellers, this flexibility is a lifesaver. Imagine planning a family trip to Europe, only to face a sudden visa delay or a family member falling ill. With CFAR, you can cancel without losing your entire investment, giving you the freedom to adapt to life’s unpredictability.

- Protection Against Financial Losses

Travel isn’t cheap, especially when you’re booking flights, hotels, and tours months in advance. Non-refundable expenses can add up quickly—think airfare to Singapore or a prepaid safari in Ranthambore. Without CFAR, cancelling for an uncovered reason could mean losing thousands of rupees. CFAR policies, however, reimburse 50-80% of your prepaid, non-refundable costs, softening the financial blow.

For example, if you’ve spent ₹2,00,000 on a non-refundable international trip and need to cancel due to a personal reason, a CFAR policy with 75% reimbursement could return ₹1,50,000 to your pocket. That’s money you can use for a future adventure or to cover unexpected expenses.

- Peace of Mind in an Unpredictable World

From sudden lockdowns to natural calamities like cyclones, Indian travellers face unique challenges. CFAR provides peace of mind by covering scenarios that standard policies don’t, such as:

- Change of mind: Decided that international travel isn’t right for you right now? No problem.

- Personal emergencies: A family member’s health issue or a work obligation can derail plans.

- Travel concerns: Worried about safety, political unrest, or pandemics? CFAR lets you cancel without hassle.

- Weather uncertainties: Monsoon season or unexpected heatwaves can make travel uncomfortable or unsafe.

With CFAR, you can book your dream vacation with confidence, knowing you’re protected no matter what life throws at you.

- Tailored for High-Value Trips

CFAR is particularly valuable for expensive or long-planned trips, such as honeymoons, international vacations, or family reunions. For instance, if you’re planning a ₹5,00,000 trip to the Maldives, CFAR can protect your investment if plans change. According to Forbes, CFAR is ideal for travellers with significant prepaid costs or those booking far in advance, as the risk of cancellation increases over time.

How Does CFAR Travel Insurance Work?

Now that you’re intrigued, let’s break down how CFAR works in practice. It’s simple but comes with a few key conditions:

- Purchase Timing: You must buy CFAR coverage within 14-21 days of your initial trip deposit. This ensures you’re committed to the trip but still have flexibility. Some providers, like Travel Insured International’s FlexiPAX plan, offer an industry-leading 21-day window.

- Full Coverage Requirement: You must insure 100% of your prepaid, non-refundable trip costs. This includes flights, hotels, tours, and other bookings. Refundable expenses, like airline tickets with vouchers, don’t qualify.

- Cancellation Deadline: Most CFAR policies require you to cancel at least 48-72 hours before your scheduled departure. Last-minute cancellations may not be covered.

- Reimbursement Limits: Expect 50-80% reimbursement of non-refundable costs. For example, Allianz offers up to 80% reimbursement, one of the highest in the industry.

- Add-On Benefit: CFAR is not a standalone policy—it’s an add-on to a comprehensive travel insurance plan, increasing the premium by 40-50%. For a ₹1,00,000 trip, a standard policy might cost ₹5,000-₹10,000, while CFAR could add ₹2,000-₹5,000 to the premium.

Top CFAR Travel Insurance Providers

Not all travel insurance providers offer CFAR, and those that do vary in reimbursement rates, purchase windows, and additional benefits. Based on the latest data, here are some top picks for Indian travellers:

- Why It Stands Out: Offers CFAR add-on with up to 75% reimbursement, seamless online claims, and comprehensive coverage for domestic/international trips.

- Best For: Frequent travelers seeking reliable claims processing.

- Why It Stands Out: Provides CFAR with 75% reimbursement, Schengen visa-compliant, and extensive hospital network for medical emergencies.

- Best For: International travelers needing visa-compliant policies.

- Why It Stands Out: CFAR add-on with 70-75% reimbursement, covers adventure activities, and offers quick claim settlements.

- Best For: Adventure travelers and budget-conscious buyers.

- Why It Stands Out: Flexible CFAR plans with 75% reimbursement, robust medical coverage, and 24/7 customer support.

- Best For: Families and corporate travelers with high-value trips.

- Why It Stands Out: Affordable CFAR add-on with 75% reimbursement, covers trip cancellations and medical emergencies, easy policy purchase.

- Best For: Budget travelers planning domestic getaways.

Is CFAR Travel Insurance Worth It for Travellers?

The million-rupee question: Is CFAR worth the extra cost? The answer depends on your travel plans, risk tolerance, and budget. Here’s a quick breakdown to help you decide:

When CFAR is a Smart Choice

- Expensive Trips: If you’re investing heavily in a trip (e.g., international travel or a luxury domestic getaway), CFAR protects your financial commitment.

- Uncertain Plans: If your work, health, or family situation is unpredictable, CFAR offers flexibility.

- High-Risk Destinations: Travelling during monsoon season or to areas with political or health concerns? CFAR covers cancellations due to safety worries.

- Advance Bookings: The longer the gap between booking and travel, the higher the risk of cancellation. CFAR is ideal for trips planned a year in advance.

When CFAR May Not Be Necessary

- Low-Cost Trips: For budget trips with minimal non-refundable costs, the extra premium might not justify the benefit.

- Firm Plans: If you’re confident about your travel plans (e.g., attending a family wedding), standard travel insurance may suffice.

- Last-Minute Bookings: The risk of cancellation is lower for trips booked close to the travel date.

Cost Considerations

CFAR policies typically cost 40-50% more than standard travel insurance. For a ₹1,00,000 trip, expect to pay ₹5,000-₹10,000 for a comprehensive policy, with CFAR adding another ₹2,000-₹5,000. While this may seem steep, the peace of mind and financial protection can outweigh the cost for high-value or uncertain trips.

Tips for Choosing the Right CFAR Policy

To maximize the benefits of CFAR travel insurance, keep these tips in mind:

- Act Fast: Purchase CFAR within 14-21 days of your initial trip deposit to meet eligibility requirements.

- Read the Fine Print: Check reimbursement rates, cancellation deadlines, and exclusions. Some policies may not cover vouchers or credits issued by airlines or hotels.

- Compare Providers: Use platforms like Squaremouth or InsureMyTrip to compare CFAR plans based on cost, coverage, and purchase windows.

- Insure the Full Trip: Ensure all non-refundable expenses are covered under the policy to maximize reimbursement.

- Check Destination Requirements: Before travelling, verify entry and exit requirements for your destination, as CFAR can cover cancellations due to unforeseen restrictions.

The Future of CFAR in India’s Travel Landscape

As travel rebounds in 2025, CFAR is gaining traction among Indian travellers. With rising airfares, complex visa processes, and unpredictable weather, the demand for flexible travel insurance is at an all-time high. According to Squaremouth, CFAR policies cost an average of ₹4,000 per day for a 12-day trip, with premiums ranging from 8-15% of the trip cost. While this may seem like an added expense, the peace of mind and financial protection make it a worthwhile investment for many.

Moreover, the post-pandemic travel landscape has made Indian travellers more cautious. CFAR’s ability to cover cancellations due to health concerns, travel restrictions, or personal reasons aligns perfectly with the needs of today’s globetrotters. Whether you’re planning a spiritual retreat to Varanasi or an international adventure, CFAR ensures you’re prepared for the unexpected.

Travel with Confidence

Life is unpredictable, but your travel plans don’t have to be. Cancel For Any Reason (CFAR) travel insurance offers Indian travellers the ultimate flexibility to cancel trips for any reason, from personal emergencies to a simple change of heart. With 50-80% reimbursement, a 14-21 day purchase window, and coverage for non-refundable expenses, CFAR is a must-have for expensive or uncertain trips.

So, the next time you book a trip—whether it’s a weekend getaway to Goa or a bucket-list journey to Europe—consider adding CFAR to your travel insurance. It’s not just insurance; it’s peace of mind, financial protection, and the freedom to travel on your terms.