In today’s world, where medical inflation is soaring at an alarming rate, securing a robust health insurance plan for you and your family is no longer a luxury—it’s a necessity. According to the IRDAI Annual Report 2022-23, health insurance premiums in India surged by 23%, and the ACKO Health Index 2024 reported an 11.35% increase in average claim sizes, reflecting the escalating costs of healthcare. With 62% of healthcare expenses in India still paid out-of-pocket and 82% of urban households lacking adequate coverage, choosing the right family health insurance plan is critical to safeguarding your financial and physical well-being. This blog dives into the best health insurance plans in India , offering insights into top policies, key features, and practical tips to help you make an informed decision.

Top 10 Health Insurance Plans for Families in India

- Sum Insured: ₹5 lakh to ₹2 crore

- Key Features: No room rent limits, no co-pay, covers home care treatments, and offers a Secure Benefit that doubles your coverage instantly (e.g., ₹10 lakh policy gives ₹20 lakh coverage). It also includes a 50% no-claim bonus annually, up to 100%, regardless of claims.

- Why Choose?: With over 10,000 network hospitals and no disease-specific sub-limits, this plan is ideal for families seeking comprehensive coverage without hidden clauses. Its Protect Benefit covers non-medical expenses like bandages and syringes at no extra cost.

- Best For: Families looking for high coverage with flexible add-ons like critical illness and global treatment coverage.

- Sum Insured: ₹5 lakh to ₹1 crore

- Key Features: Unlimited teleconsultations, no sub-limits on treatments, and coverage for maternity, IVF, adoption, and surrogacy. Offers a Booster Benefit that increases sum insured by 100% for claim-free years.

- Why Choose?: Tailored for middle-class families, it provides affordable premiums and extensive coverage, including 20 critical illnesses. Its OPD Wallet covers consultations, pharmacy, and wellness services.

- Best For: Young couples planning to start a family, with a focus on maternity and pediatric care.

- Sum Insured: ₹5 lakh to ₹1 crore

- Key Features: No disease-wise sub-limits, covers AYUSH treatments, and offers unlimited e-consultations. Provides a Stay Active benefit with discounts for maintaining fitness goals via the Care Health app.

- Why Choose?: With a 53.82% Incurred Claim Ratio (ICR) and 24,800+ network hospitals, Care Supreme ensures accessibility and reliability. Its restoration benefit replenishes 100% of the sum insured.

- Best For: Health-conscious families seeking wellness incentives and high coverage.

- Sum Insured: ₹5 lakh to ₹3 crore

- Key Features: Global coverage for emergency treatments, maternity benefits, and coverage for bariatric surgeries. Offers up to ₹10,000 for annual health check-ups and a 5-10% premium discount for multi-year policies.

- Why Choose?: Ideal for families with international travel needs, it covers treatments abroad if diagnosed in India. Its high sum insured options make it suitable for large families.

- Best For: Affluent families seeking premium coverage with global benefits.

- Sum Insured: ₹2 lakh to ₹6 crore

- Key Features: Seven variants (MAX, VYTL, NXT, VIP, VIP+, MAX+, SAVR) with 100% HealthReturns for healthy lifestyles. Covers cancer screening, critical illness, and personal accident add-ons.

- Why Choose?: Offers personalized coverage with incentives like cashback for wellness activities. No maximum entry age and a reduced PED waiting period make it inclusive.

- Best For: Families with senior citizens and those prioritizing preventive care.

- Sum Insured: ₹3 lakh to ₹25 lakh

- Key Features: Covers daycare procedures, organ donor expenses, and maternity benefits. Offers a 100% no-claim bonus and cashless hospitalization at 14,000+ network hospitals.

- Why Choose?: Known for its quick claim settlement and high CSR (96%), it’s a reliable choice for cost-conscious families.

- Best For: Small to medium-sized families seeking affordable yet comprehensive plans.

- Sum Insured: ₹1.5 lakh to ₹50 lakh

- Key Features: Covers critical illnesses, AYUSH treatments, and provides hospital daily cash benefits. Offers a family discount and no-claim bonus up to 100%.

- Why Choose?: With a wide network of hospitals and flexible add-ons, it’s ideal for families needing tailored coverage.

- Best For: Middle-income families balancing cost and benefits.

- Sum Insured: ₹2.5 lakh to ₹1 crore

- Key Features: Covers OPD expenses, critical illnesses, and worldwide emergency care. Offers up to 35% discounts, including 5% for online bookings.

- Why Choose?: Its 2-year PED waiting period and free health check-ups make it attractive for families with pre-existing conditions.

- Best For: Families seeking customizable plans with OPD benefits.

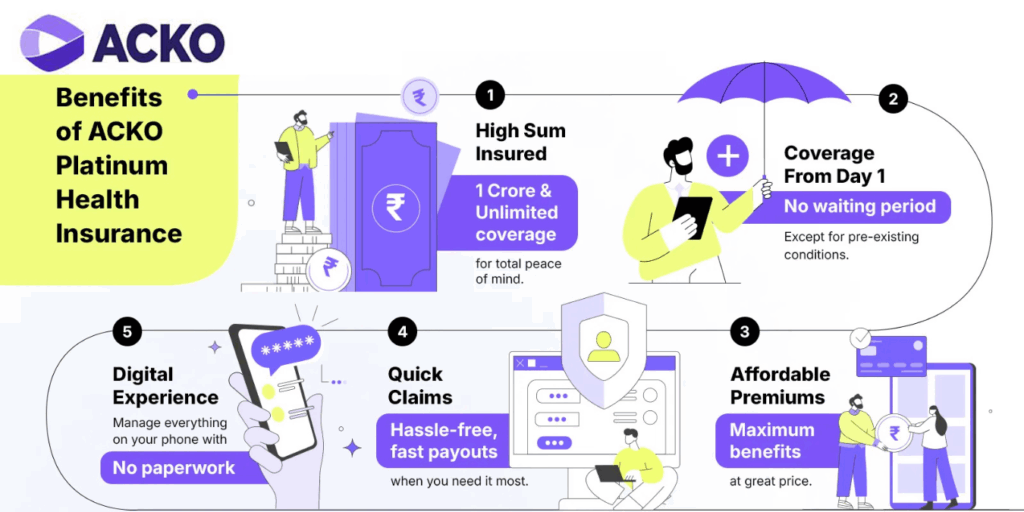

- Sum Insured: Up to ₹1 crore

- Key Features: Zero deductions on claims, day-1 coverage for PEDs (in some cases), and the ability to add up to 10 family members. Offers inflation protection instead of no-claim bonuses.

- Why Choose?: Known for its transparency and high CSR, ACKO is a top choice for tech-savvy families.

- Best For: Large families needing high coverage with minimal out-of-pocket expenses.

- Sum Insured: ₹5 lakh to ₹1 crore

- Key Features: Covers 20 critical illnesses, offers no pre-policy health check-ups, and provides cashless hospitalization at 7,500+ hospitals. Includes annual health check-ups from day one.

- Why Choose?: Its flexibility in covering critical illnesses and no medical screening make it accessible for all age groups.

- Best For: Families with diverse medical needs, including chronic conditions.

Comparison of health insurance plan

Below is a detailed comparison of the top 10 health insurance plans for families in India, focusing on key parameters like sum insured, key features, network hospitals, claim settlement ratio (CSR), and ideal use cases. The data is sourced from trusted platforms IRDAI Annual Report 2022-23, ACKO Health Index 2024.

Health Insurance Plan | Sum Insured | Key Features | Network Hospitals | Claim Settlement Ratio (CSR) | Best For |

HDFC ERGO Optima Secure | ₹5 lakh – ₹2 crore | No room rent limits, no co-pay, doubles coverage via Secure Benefit, 50% no-claim bonus, covers non-medical expenses | 10,000+ | 98% | Families seeking high coverage with flexible add-ons like critical illness and global treatment |

Niva Bupa Reassure 2.0 Platinum+ | ₹5 lakh – ₹1 crore | Unlimited teleconsultations, maternity/IVF coverage, 100% booster benefit, OPD wallet for consultations | 10,000+ | 94% | Young couples planning families, needing maternity and pediatric care |

Care Supreme | ₹5 lakh – ₹1 crore | No disease sub-limits, AYUSH coverage, unlimited e-consultations, Stay Active discounts, 100% restoration | 24,800+ | 93% (53.82% ICR) | Health-conscious families prioritizing wellness and high coverage |

Tata AIG Medicare Premier | ₹5 lakh – ₹3 crore | Global emergency coverage, maternity benefits, bariatric surgery, ₹10,000 health check-ups, multi-year discounts | 7,200+ | 95% | Affluent families with international travel needs |

Aditya Birla Activ One | ₹2 lakh – ₹6 crore | 100% HealthReturns, cancer screening, critical illness, no max entry age, reduced PED waiting | 10,000+ | 92% | Families with senior citizens and preventive care focus |

Star Health Family Health Optima | ₹3 lakh – ₹25 lakh | Daycare procedures, organ donor, maternity benefits, 100% no-claim bonus | 14,000+ | 96% | Small to medium-sized families seeking affordable comprehensive plans |

Bajaj Allianz Health Guard | ₹1.5 lakh – ₹50 lakh | Critical illness, AYUSH, hospital daily cash, family discounts, 100% no-claim bonus | 8,000+ | 93% | Middle-income families balancing cost and benefits |

ManipalCigna ProHealth Insurance | ₹2.5 lakh – ₹1 crore | OPD expenses, critical illness, worldwide emergency care, 2-year PED waiting, 35% discounts | 8,500+ | 91% | Families needing customizable plans with OPD benefits |

ACKO Platinum Health Plan | Up to ₹1 crore | Zero claim deductions, day-1 PED coverage (some cases), up to 10 family members, inflation protection | 7,000+ | 99% | Large families needing high coverage with minimal out-of-pocket costs |

ICICI Lombard Health AdvantEdge | ₹5 lakh – ₹1 crore | 20 critical illnesses, no pre-policy check-ups, annual health check-ups, cashless hospitalization | 7,500+ | 94% | Families with diverse medical needs, including chronic conditions |

Why Family Health Insurance Matters

The rising cost of medical treatments, coupled with lifestyle-related illnesses like diabetes, heart disease, and cancer, makes family floater health insurance an essential investment. A single hospitalization can drain savings, with costs for procedures like heart surgery or organ transplants often exceeding ₹5-6 lakh. Family health insurance plans provide comprehensive coverage for your entire household—spouse, children, parents, and even in-laws—under a single premium, making them cost-effective compared to individual plans. Additionally, under Section 80D of the Income Tax Act, 1961, you can claim tax deductions of up to ₹25,000 (or ₹50,000 for senior citizens) on premiums, enhancing their financial appeal.

But with countless options in the market, how do you choose the best health insurance plan for your family? This guide explores top plans, key factors to consider, and insider tips to ensure you select a policy that balances affordability, coverage, and reliability.

Key Factors to Consider When Choosing a Health Insurance Plan

Before diving into the top plans, let’s understand the critical factors to evaluate when selecting a health insurance policy:

- Sum Insured: Choose a plan with a sum insured that matches your family’s medical needs. Experts recommend at least ₹10 lakh for urban families, especially if senior citizens are included, due to rising medical costs.

- Network Hospitals: Opt for insurers with a wide network of cashless hospitals (e.g., 10,000+ hospitals) to ensure hassle-free treatment.

- Claim Settlement Ratio (CSR): A CSR above 90% indicates reliability in settling claims. For instance, Onsurity (99%) and Star Health (96%) are known for high CSRs.

- Pre-Existing Disease (PED) Coverage: Look for plans with shorter waiting periods (e.g., 1-2 years) for PEDs, especially if family members have chronic conditions.

- Additional Benefits: Wellness programs, free health check-ups, maternity benefits, and no-claim bonuses can add significant value.

- Premium Affordability: Balance premium costs with coverage to avoid compromising on essential benefits.

- Restoration Benefits: Plans with unlimited or 100% sum insured restoration ensure coverage isn’t exhausted in a single claim.

Tips to Choose the Best Health Insurance Plan

- Assess Family Needs: Consider the age, medical history, and lifestyle of family members. For instance, families with senior citizens need higher sum insured and PED coverage, while young couples may prioritize maternity benefits.

- Compare Plans Online: Use platforms like Policybazaar or PolicyX to compare premiums, coverage, and network hospitals. These aggregators simplify decision-making by presenting multiple options.

- Check Add-Ons: Opt for add-ons like critical illness cover, personal accident cover, or maternity benefits to enhance your policy’s scope.

- Read Policy Documents: Understand exclusions (e.g., war-related injuries, cosmetic surgeries) and waiting periods to avoid surprises during claims.

- Consult Experts: Platforms like Ditto Insurance offer free consultations to guide you through complex policy terms.

The Rising Need for Health Insurance in India

With one in nine Indians at risk of developing cancer and chronic diseases contributing to 53% of deaths, health insurance is a critical safety net. Plans like HDFC ERGO Optima Secure and Niva Bupa Reassure 2.0 address these concerns by offering comprehensive coverage, including critical illness and cancer-specific benefits. Moreover, the no-claim bonus and restoration benefits ensure your coverage grows with your needs, while cashless hospitalization at network hospitals minimizes financial stress during emergencies.

Secure Your Family’s Future Today

Choosing the best health insurance plan for your family in 2025 requires balancing coverage, affordability, and reliability. Plans like HDFC ERGO Optima Secure, Niva Bupa Reassure 2.0, and Care Supreme stand out for their comprehensive features, high CSR, and extensive hospital networks. By prioritizing factors like sum insured, PED waiting periods, and add-on benefits, you can find a policy tailored to your family’s unique needs.

Don’t wait for a medical emergency to act. Compare plans on trusted platforms, consult with experts, and invest in a family health insurance plan today to ensure peace of mind and financial security for years to come.

Share this:

- Share on Facebook (Opens in new window) Facebook

- Share on X (Opens in new window) X

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on Reddit (Opens in new window) Reddit

- Share on X (Opens in new window) X

- Share on Tumblr (Opens in new window) Tumblr

- Share on Pinterest (Opens in new window) Pinterest

- Share on Telegram (Opens in new window) Telegram

- Share on WhatsApp (Opens in new window) WhatsApp

- Email a link to a friend (Opens in new window) Email