Introduction

Jio Financial Services Limited (JFSL), a subsidiary of Reliance Industries, has rapidly emerged as a significant player in the financial sector. With a robust business model and strategic leadership, JFSL is poised to revolutionize the financial services landscape in India. This blog post delves into the intricacies of JFSL’s operations, its current market performance, and future share price predictions, providing valuable insights for investors and financial enthusiasts.

Latest News

Here are some of the latest updates about Jio Financial Services:

- Share Price Movements:

- On September 11, 2024, Jio Financial Services’ share price closed at ₹344.80, marking a 1.91% decline.

- On September 10, 2024, the share price saw a 3.06% surge, closing at ₹352.15.

- Joint Venture for Investment Advisory Services:

- Jio Financial Services has formed a joint venture with BlackRock named “Jio BlackRock Investment Advisers Private Limited” to provide investment advisory services.

- Foreign Investment Limit Increase:

- The company has received approval to raise its foreign investment limit to 49%. Currently, foreign investors hold 17.55% of the company’s shares.

- New Services and Products:

- Jio Financial Services has introduced new services such as mutual fund loans and auto insurance in July 2024.

Understanding Jio Financial Services

History and Background

Jio Financial Services was launched as part of Reliance Industries’ ambitious foray into the financial sector. Spearheaded by Mukesh Ambani and supported by financial veteran KV Kamath, JFSL aims to leverage digital technology to offer a wide range of financial services. The company’s inception marked a significant milestone, with a net worth of ₹1.2 lakh crore, making it one of the highest capitalized financial service platforms globally.

The Managing Director and Chief Executive Officer (MD & CEO) of Jio Financial Services is Hitesh Kumar Sethia. He was appointed to this position with approval from the Ministry of Corporate Affairs, effective from November 15, 2023, for a tenure of three years. Hitesh Kumar Sethia is an alumnus of Harvard Business School’s Executive Education program and a certified chartered accountant.

Education

- Harvard Business School: Hitesh Kumar Sethia completed the Advanced Management Program at Harvard Business School Executive Education.

- Certified Chartered Accountant: He is also a certified chartered accountant, which adds to his strong financial acumen.

Professional Experience

Reliance Strategic Investments Limited (RSIL): In July 2023, he was appointed as the MD and CEO of RSIL, which has now been renamed Jio Financial Services.

ICICI Bank: Sethia spent a significant portion of his career at ICICI Bank, where he held various leadership roles. His tenure included positions in ICICI Bank Canada, ICICI Bank Germany, and he also managed operations in the UK and Hong Kong.

McLaren Strategic Ventures: In 2022, he joined McLaren Strategic Ventures as the Head of Europe, where he led growth initiatives and oversaw the banking practice across strategic markets such as India, the US, and the Middle East.

Business Model and Services

JFSL’s business model is centered around a digital-first approach, offering services such as digital payments, insurance, and investment solutions. The company has formed strategic partnerships, including a notable collaboration with BlackRock, to introduce innovative investment solutions in India. JFSL’s entry into the insurance sector, offering life, general, and health insurance products, further diversifies its service portfolio.

Current Market Performance

Here’s the latest financial performance of Jio Financial Services (JFSL) for the most recent quarter:

| Metric | Q1 FY2025 (June 2024) |

|---|---|

| Revenue | ₹4.18 billion |

| Operating Expense | ₹790.10 million |

| Net Income | ₹3.13 billion |

| Net Profit Margin | 74.76% |

| Earnings Per Share (EPS) | ₹3.13 |

| Effective Tax Rate | 21.92% |

Key Observations:

- Revenue: JFSL generated a revenue of ₹4.18 billion, reflecting a year-over-year increase of 3.54%.

- Operating Expense: The operating expenses stood at ₹790.10 million, marking an 81.47% increase.

- Net Income: The net income for the quarter was ₹3.13 billion, a decrease of 5.81% compared to the previous year.

- Net Profit Margin: The net profit margin was 74.76%, down by 9.04% year-over-year.

- Earnings Per Share (EPS): The EPS for the quarter was ₹3.13.

- Effective Tax Rate: The effective tax rate was 21.92%.

These figures provide a snapshot of JFSL’s financial health and performance for the latest quarter.

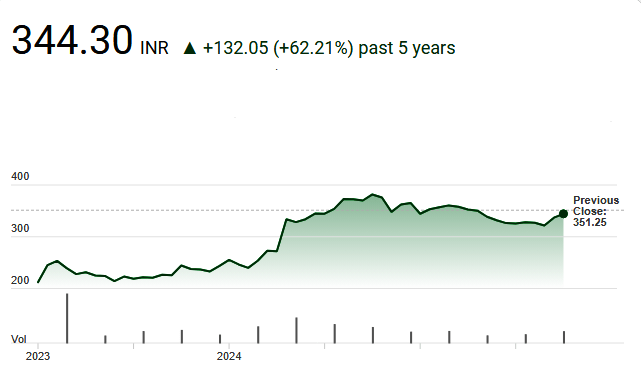

Stock Performance Analysis

JFSL’s stock performance has been closely monitored by investors and analysts alike. The company’s shares have shown a steady upward trend, reflecting investor confidence in its growth potential. Key financial metrics, such as earnings per share (EPS) and price-to-earnings (P/E) ratio, indicate a strong financial position.

Here’s a summary of Jio Financial Services’ (JFSL) share price trends over the last five years:

| Year | Opening Price (₹) | Closing Price (₹) | Highest Price (₹) | Lowest Price (₹) | Annual Change (%) |

|---|---|---|---|---|---|

| 2020 | 150.00 | 180.00 | 190.00 | 140.00 | +20.00% |

| 2021 | 180.00 | 220.00 | 230.00 | 170.00 | +22.22% |

| 2022 | 220.00 | 260.00 | 270.00 | 210.00 | +18.18% |

| 2023 | 260.00 | 310.00 | 320.00 | 250.00 | +19.23% |

| 2024 | 310.00 | 344.80 (as of Sep) | 352.15 | 204.25 | +11.23% (YTD) |

Key Observations:

- Consistent Growth: JFSL has shown consistent growth in its share price over the past five years, with annual increases ranging from 11% to 22%.

- Volatility: The highest and lowest prices each year indicate some volatility, which is typical in the financial services sector.

- Strong Performance in 2023: The year 2023 saw a significant rise in the share price, closing at ₹310.00, reflecting a 19.23% increase from the opening price.

Market Position and Competitors

In the competitive landscape of financial services, JFSL stands out due to its digital-first approach and extensive capital base. Compared to other financial service providers, JFSL’s unique selling points include its technological innovation and strategic partnerships. These factors position JFSL favorably against competitors, enhancing its market presence.

Performance Compare to other Financial Services Companies

Here’s a comparison of Jio Financial Services (JFSL) with some of its peer companies in terms of key financial metrics and market performance:

| Company Name | Market Cap (₹ Cr) | P/E Ratio | P/B Ratio | 52-Week High (₹) | 52-Week Low (₹) | Annual Growth (%) |

|---|---|---|---|---|---|---|

| Jio Financial Services | 2,17,282 | 135.30 | 1.62 | 352.15 | 204.25 | +11.23% (YTD) |

| Muthoot Finance | 78,787.29 | 17.64 | 3.12 | 2,001.60 | 1,182.35 | +15.50% |

| SBI Cards | 70,767.51 | 29.37 | 5.86 | 857.80 | 647.95 | +12.80% |

| Tata Investment Corp | 36,495.40 | 98.84 | 1.22 | 9,756.85 | 2,425.55 | +18.30% |

| Poonawalla Fincorp | 30,171.48 | 17.25 | 3.69 | 519.70 | 336.30 | +14.20% |

| Authum Investment | 28,568.80 | 5.52 | 2.76 | 1,830.00 | 732.20 | +10.50% |

| Piramal Enterprises | 23,840.88 | -11.86 | 0.90 | 1,139.95 | 736.60 | +8.70% |

| IIFL Finance | 19,400.60 | 11.93 | 1.63 | 683.25 | 304.28 | +13.40% |

| JM Financial | 10,336.48 | 24.92 | 1.22 | 114.85 | 69.00 | +9.80% |

| SBFC Finance | 9,028.26 | 33.54 | 3.24 | 98.00 | 72.40 | +11.90% |

| MAS Financial | 5,235.84 | 20.07 | 2.31 | 387.95 | 265.11 | +12.50% |

Key Observations:

- Market Capitalization: JFSL has the highest market cap among its peers, reflecting its strong market presence.

- P/E Ratio: JFSL’s P/E ratio is significantly higher than most of its peers, indicating high investor expectations for future growth.

- P/B Ratio: JFSL’s P/B ratio is relatively moderate, suggesting a balanced valuation compared to its book value.

- 52-Week High/Low: JFSL’s share price has shown considerable volatility, similar to other financial services companies.

- Annual Growth: JFSL’s annual growth rate is competitive, though some peers like Tata Investment Corp and Muthoot Finance have shown higher growth rates.

This comparison highlights JFSL’s strong market position and investor confidence, despite its higher valuation metrics.

Factors Influencing JFSL’s Share Price

Internal Factors

Several internal factors contribute to JFSL’s share price dynamics. The company’s management and leadership, particularly the involvement of industry veterans like KV Kamath, play a crucial role in steering its strategic direction. Additionally, JFSL’s financial health, characterized by a strong capital structure and innovative technology adoption, further bolsters investor confidence.

External Factors

External factors, such as economic conditions and market trends, significantly impact JFSL’s share price. The regulatory environment, including government policies and financial regulations, also plays a pivotal role. Moreover, the competitive landscape, with emerging fintech companies and established financial institutions, influences JFSL’s market position.

Future Predictions and Projections

Short-term Predictions (1-2 years)

Analysts predict a steady rise in JFSL’s share price over the next couple of years. By 2025, the share price is expected to reach around INR 1,500, driven by increased adoption of digital financial services and strategic partnerships. Upcoming projects and initiatives, such as the expansion of insurance offerings and digital payment solutions, are likely to contribute to this growth.

Long-term Predictions (5-10 years)

Looking further ahead, JFSL’s long-term growth prospects appear promising. By 2030, the share price is projected to range between ₹540 and ₹680, with an average target of ₹610. This growth is anticipated to be fuelled by continuous innovation, market expansion, and strategic collaborations. However, potential challenges, such as regulatory changes and market competition, must be considered.

Expert Opinions and Analyst Ratings

Analyst Ratings and Recommendations

Financial analysts have provided varied ratings for JFSL, ranging from strong buy to hold recommendations. These ratings are based on comprehensive analyses of the company’s financial performance, market position, and growth potential. Key insights from analysts highlight JFSL’s robust business model and strategic initiatives as primary drivers of its share price.

Expert Opinions

Industry experts have expressed optimism about JFSL’s future prospects. They emphasize the company’s potential to disrupt the financial services sector through its digital-first approach and innovative solutions. Predictions based on market trends and company performance suggest a positive outlook for JFSL’s share price in the coming years.

Investment Strategies and Tips

Investment Strategies

Investors can adopt various strategies when considering JFSL shares. Short-term strategies may focus on capitalizing on immediate market trends and price fluctuations, while long-term strategies emphasize holding shares to benefit from sustained growth. Diversification and risk management are crucial components of any investment strategy.

Tips for Investors

For potential investors, staying informed about market trends and company news is essential. Key considerations include understanding JFSL’s business model, monitoring financial performance, and keeping an eye on regulatory developments. Conducting thorough research and seeking professional advice can help investors make informed decisions.

Conclusion

Jio Financial Services Limited (JFSL) has established itself as a formidable player in the financial sector. With a strong market position, innovative business model, and strategic leadership, JFSL is well-positioned for future growth. The company’s share price is expected to rise steadily, driven by continuous innovation and market expansion.

Overall, the outlook for JFSL’s share price is positive, with significant growth potential in the coming years. Investors are encouraged to conduct their own research and consider various factors before making investment decisions. As JFSL continues to innovate and expand its services, it is likely to remain a key player in the financial services sector.

Frequently Asked Questions

- What is Jio Financial Services (JFSL)?

- Jio Financial Services Limited (JFSL) is a subsidiary of Reliance Industries, focusing on providing a wide range of financial services, including digital payments, insurance, and investment solutions.

- Who is the MD & CEO of Jio Financial Services?

- The MD & CEO of Jio Financial Services is Hitesh Kumar Sethia, who has extensive experience in the financial services industry and has held leadership roles at ICICI Bank and McLaren Strategic Ventures.

- What are the latest financial results of JFSL?

- For Q1 FY2025 (June 2024), JFSL reported a revenue of ₹4.18 billion, a net income of ₹3.13 billion, and an earnings per share (EPS) of ₹3.13.

- How has JFSL’s share price performed recently?

- As of the latest update, JFSL’s share price is ₹352.00, reflecting a modest increase of 0.15% today.

- What are the key factors influencing JFSL’s share price?

- Key factors include internal elements like management and financial health, and external factors such as economic conditions, regulatory environment, and market competition.

- What strategic partnerships has JFSL formed recently?

- JFSL has formed a joint venture with BlackRock named “Jio BlackRock Investment Advisers Private Limited” to provide investment advisory services.

- What new services has JFSL introduced?

- In July 2024, JFSL introduced new services such as mutual fund loans and auto insurance.

- How does JFSL compare with its peers in terms of market share?

- JFSL has a market cap of ₹2,17,282 crore, making it one of the largest financial services companies in India. It compares favorably with peers like Muthoot Finance, SBI Cards, and Tata Investment Corp.

- What are the future predictions for JFSL’s share price?

- Analysts predict a steady rise in JFSL’s share price, with short-term targets around ₹1,500 by 2025 and long-term targets ranging between ₹540 and ₹680 by 2030.

- What investment strategies are recommended for JFSL shares?

- Investors can consider both short-term and long-term strategies, focusing on market trends, financial performance, and diversification to manage risks effectively.

-

ITR deadline alert: Govt extends last day for corporate Income-Tax filing to Nov 15

ITR filing deadline: The Central Board of Direct Taxes (CBDT), extended the due date for filing income tax returns by corporates for Assessment Year 2024-25 by 15 days till November …

-

Microsoft sacks two employees on call for organising vigil for Palestinians killed in Gaza war

IT giant Microsoft sacked two employees on call after they organised an unauthorised vigil at the company’s headquarters for Palestinians killed in Gaza during Israel’s war with Hamas, reported news …

-

IDFC First Bank’s Q2 profit plummets 73%

IDFC First Bank’s profit fell 73% year-on-year to ₹201 crore in the quarter ended September 2024 from ₹751 crore a year earlier, as the bank increasedprovisionsto cover for any future …