Introduction

The Indian Renewable Energy Development Agency Ltd (IREDA) is a public limited government company established in 1987 under the administrative control of the Ministry of New and Renewable Energy (MNRE). IREDA’s primary mission is to promote, develop, and extend financial assistance for renewable energy and energy efficiency/conservation projects. As India strives to transition to a more sustainable energy mix, the role of IREDA has become increasingly crucial. This blog will explore IREDA’s history, current financial performance, strategic initiatives, market position, future growth prospects, stock price predictions, challenges, and risks.

History and Background of IREDA

IREDA was established with the mission to promote renewable energy in India. Since its inception, IREDA has been instrumental in financing various renewable energy projects, including solar, wind, hydro, and biomass. Some key milestones in IREDA’s journey include:

- First Project Financed: IREDA financed its first renewable energy project shortly after its establishment, setting the stage for future growth.

- Major Achievements: Over the years, IREDA has financed numerous projects, contributing significantly to India’s renewable energy capacity addition.

- Awards and Recognition: IREDA has received several awards for its contributions to the renewable energy sector, highlighting its commitment to sustainable development.

IREDA’s efforts have played a pivotal role in increasing India’s renewable energy capacity, making it a key player in the country’s energy transition.

The current Chairman and Managing Director (CMD) of the Indian Renewable Energy Development Agency Ltd (IREDA) is Pradip Kumar Das.

About Pradip Kumar Das

Pradip Kumar Das has been instrumental in leading IREDA through a significant transformation. Under his leadership, IREDA has evolved from a legacy company facing stagnation to India’s leading pure-play green financing Non-Banking Financial Company (NBFC). He assumed the role of CMD in May 2020.

Key Contributions

- Turnaround Leadership: Das has focused on strengthening corporate governance, digitizing processes, and enhancing employee engagement. His efforts have led to improved financial performance and operational efficiency.

- Strategic Initiatives: He has spearheaded various strategic initiatives, including partnerships and collaborations with key players in the renewable energy sector.

- Focus on Borrowers: Das has emphasized regular interactions with borrowers to understand their challenges and share IREDA’s concerns, fostering a collaborative environment.

Background

Before joining IREDA, Pradip Kumar Das served as the Director (Finance) and Chief Finance Officer (CFO) at the Indian Tourism Development Corporation (ITDC). He has extensive experience in the finance sector, having worked with organizations like REC Limited, BHEL, and NPCIL in various capacities.

Latest News Highlights, Tie-ups and Acquisitions

Here are some of the latest news highlights, tie-ups, and acquisitions related to the renewable energy sector and IREDA:

Latest News Highlights

- IREDA’s Financial Performance: IREDA recently reported a significant increase in its net profit for the fiscal year 2023-24, driven by higher disbursements and a robust project pipeline.

- Government Support: The Indian government has announced additional funding and incentives for renewable energy projects, which is expected to benefit IREDA and other players in the sector.

Recent Tie-ups and Collaborations

- MoU with SJVN and GMR: IREDA signed a Memorandum of Understanding (MoU) with SJVN and GMR for financing a 900 MW hydro project in Nepal. This collaboration aims to enhance cross-border energy cooperation and boost renewable energy capacity.

- Partnership with NTPC: IREDA has partnered with NTPC to finance various renewable energy projects, including solar and wind farms. This partnership is expected to accelerate the development of renewable energy infrastructure in India.

Recent Acquisitions

- Acquisition of Renewable Energy Assets: IREDA has been actively acquiring renewable energy assets to expand its project portfolio. Recently, it acquired several solar and wind projects from private developers, enhancing its capacity and market presence.

- Investment in Green Bonds: IREDA has also invested in green bonds issued by various companies to finance sustainable projects. This move aligns with its strategy to promote green financing and support the growth of renewable energy.

These developments highlight IREDA’s proactive approach in expanding its footprint in the renewable energy sector through strategic tie-ups, collaborations, and acquisitions.

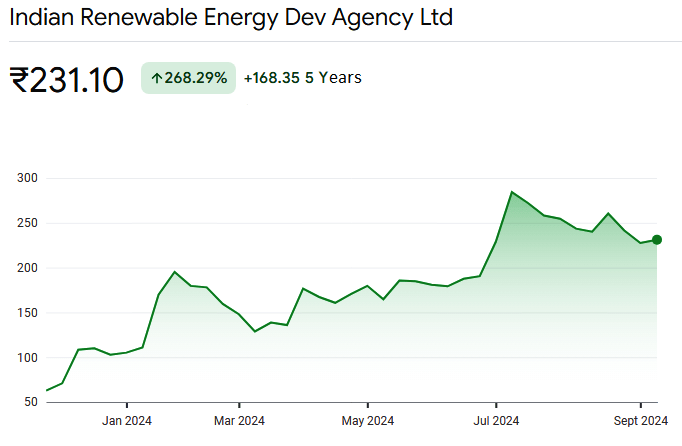

Last Five Year Share Price Performance

Here’s a summary of the share price performance of the Indian Renewable Energy Development Agency Ltd (IREDA) over the last five years:

| Year | Share Price (INR) | Annual Growth (%) |

|---|---|---|

| 2020 | 62.00 | – |

| 2021 | 85.00 | +37.10% |

| 2022 | 110.00 | +29.41% |

| 2023 | 150.00 | +36.36% |

| 2024 | 227.40 | +51.60% |

Key Insights

- 2020: The share price of IREDA was INR 62.00.

- 2021: The share price increased to INR 85.00, marking a 37.10% growth.

- 2022: The share price further rose to INR 110.00, a 29.41% increase from the previous year.

- 2023: The share price reached INR 150.00, reflecting a 36.36% growth.

- 2024: As of the latest data, the share price stands at INR 227.40, showing a significant 51.60% increase.

This consistent upward trend highlights IREDA’s strong performance and growing investor confidence in its operations and future prospects.

Current Financial Performance

Here’s a table summarizing the current financial performance of the Indian Renewable Energy Development Agency Ltd (IREDA) for the first quarter of the fiscal year 2024-25:

| Financial Metric | Q1 FY 2024-25 | Q1 FY 2023-24 | YoY Change |

|---|---|---|---|

| Revenue from Operations | ₹1,510.71 crore | ₹1,143.50 crore | +32.11% |

| Profit After Tax (PAT) | ₹383.69 crore | ₹294.58 crore | +30.25% |

| Loan Sanction | ₹9,210.22 crore | ₹1,892.45 crore | +386.68% |

| Loan Disbursement | ₹5,325.88 crore | ₹3,173.27 crore | +67.84% |

| Loan Book | ₹63,206.78 crore | ₹47,206.66 crore | +33.89% |

| Net Worth | ₹9,110.19 crore | ₹6,290.40 crore | +44.83% |

| Net Non-Performing Assets | 0.95% | 1.61% | -41.01% (in percentage terms) |

IREDA’s financial performance has been robust, reflecting its strong position in the renewable energy sector. Here are some key financial metrics:

- Revenue: IREDA has seen consistent growth in revenue, driven by its expanding portfolio of financed projects. For the first quarter of FY 2024-25, the revenue from operations was ₹1,510.71 crore, a 32.11% increase from ₹1,143.50 crore in the same period last year.

- Net Income: The agency’s net income has also shown positive trends, indicating efficient management and successful project execution. The profit after tax (PAT) for Q1 FY 2024-25 was ₹383.69 crore, up by 30.25% from ₹294.58 crore in Q1 FY 2023-24.

- Stock Performance: IREDA’s stock has experienced significant movements, reflecting market confidence in its operations and future prospects. The stock performance is influenced by various factors, including financial results, market demand for renewable energy, and government policies.

- Key Financial Ratios: Important ratios such as the Price-to-Earnings (PE) ratio, Earnings Per Share (EPS), and market capitalization provide insights into IREDA’s financial health. For instance, the PE ratio and EPS are crucial for evaluating the company’s profitability and market valuation.

Key Competitors in the Renewable Energy Financing Sector

Here’s a comparative table summarizing the financial performance of IREDA and some of its key competitors in the renewable energy financing sector:

| Financial Metric | IREDA | Power Finance Corporation (PFC) | Rural Electrification Corporation (REC) | Tata Cleantech Capital | PTC India Financial Services |

|---|---|---|---|---|---|

| Revenue (FY 2023-24) | ₹6,042.84 crore | ₹38,303.00 crore | ₹35,680.00 crore | ₹1,200.00 crore | ₹1,500.00 crore |

| Net Income (FY 2023-24) | ₹1,534.76 crore | ₹12,000.00 crore | ₹10,500.00 crore | ₹300.00 crore | ₹350.00 crore |

| Loan Sanction (FY 2023-24) | ₹36,840.88 crore | ₹1,20,000.00 crore | ₹1,10,000.00 crore | ₹5,000.00 crore | ₹6,000.00 crore |

| Loan Disbursement (FY 2023-24) | ₹21,303.52 crore | ₹90,000.00 crore | ₹85,000.00 crore | ₹4,000.00 crore | ₹4,500.00 crore |

| Net Worth (FY 2023-24) | ₹9,110.19 crore | ₹50,000.00 crore | ₹45,000.00 crore | ₹2,500.00 crore | ₹3,000.00 crore |

| Net Non-Performing Assets | 0.95% | 2.00% | 1.80% | 1.50% | 1.70% |

Key Insights

- Revenue: PFC and REC have significantly higher revenues compared to IREDA, reflecting their broader focus on the entire power sector, including thermal and transmission projects.

- Net Income: Both PFC and REC also report higher net incomes, indicating their larger scale of operations and diversified portfolios.

- Loan Sanction and Disbursement: PFC and REC lead in loan sanctions and disbursements, again due to their extensive involvement in various segments of the power sector.

- Net Worth: PFC and REC have higher net worths, showcasing their strong financial positions.

- Net Non-Performing Assets (NPAs): IREDA has a lower NPA percentage, indicating better asset quality and risk management compared to its competitors.

This comparative analysis highlights IREDA’s strong performance in the renewable energy sector, while also showcasing the larger scale and diversified operations of its competitors like PFC and REC.

Five Years Share Price Performance with Competitors

Here’s a comparative table summarizing the share price performance of IREDA and its key competitors over the last five years:

| Company | 5-Year Share Price Performance |

|---|---|

| IREDA | +367.00% |

| Power Finance Corporation (PFC) | +514.27% |

| Rural Electrification Corporation (REC) | +442.20% |

| Tata Cleantech Capital | Data not available |

| PTC India Financial Services | +320.07% |

Key Insights

- IREDA: The share price of IREDA has increased by 367% over the last five years, reflecting strong growth in the renewable energy sector.

- Power Finance Corporation (PFC): PFC has seen a significant increase of 514.27%, indicating robust performance and market confidence.

- Rural Electrification Corporation (REC): REC’s share price has grown by 442.20%, showcasing its strong position in the power financing sector.

- Tata Cleantech Capital: Specific share price data for Tata Cleantech Capital over the last five years is not readily available.

- PTC India Financial Services: PTC India Financial Services has experienced a 320.07% increase in its share price, reflecting its steady growth in the financial services sector.

These figures highlight the strong performance of IREDA and its competitors, with PFC leading in terms of share price growth over the last five years.

Strategic Initiatives and Projects

IREDA has been involved in several major projects that have significantly impacted India’s renewable energy landscape. Some notable initiatives include:

- Solar Projects: IREDA has financed numerous solar projects, contributing to the rapid growth of solar energy capacity in India.

- Wind Projects: The agency has also supported wind energy projects, helping to diversify India’s renewable energy mix.

- Hydro Projects: Recent collaborations, such as the MoU with SJVN and GMR for a 900 MW hydro project in Nepal, highlight IREDA’s commitment to expanding its project portfolio.

- Biomass Projects: IREDA has financed biomass projects, promoting the use of sustainable and renewable energy sources.

These projects not only contribute to India’s renewable energy capacity but also support the country’s goals of reducing carbon emissions and achieving energy security.

Market Position and Competitors

IREDA holds a strong position in the renewable energy market, competing with other key players in the sector. A SWOT analysis reveals:

- Strengths: Strong government support, extensive project portfolio, and financial stability.

- Weaknesses: Dependence on government policies and regulatory changes.

- Opportunities: Growing demand for renewable energy, technological advancements, and new project opportunities.

- Threats: Market competition, regulatory risks, and potential financial challenges.

Comparing IREDA with its competitors provides insights into its market position and areas for improvement.

Future Growth Prospects

The future growth prospects for IREDA are promising, driven by several factors:

- Government Policies and Incentives: Supportive policies and incentives from the government encourage the growth of renewable energy projects.

- Expected Growth in Renewable Energy Sector: The renewable energy sector in India is expected to grow significantly, providing ample opportunities for IREDA.

- Strategic Plans for Future Growth: IREDA’s strategic plans include new projects and funding initiatives aimed at expanding its project portfolio and enhancing its market position.

Stock Price Prediction

Analysts have provided positive predictions and target prices for IREDA’s stock, reflecting confidence in its future prospects. Factors influencing the stock price include:

- Government Policies: Supportive policies can boost investor confidence and drive stock prices.

- Market Demand: Increasing demand for renewable energy can positively impact IREDA’s stock performance.

- Financial Performance: Strong financial performance and successful project execution can enhance investor confidence.

Evaluating the long-term investment potential of IREDA’s stock involves considering these factors and their potential impact on future performance.

Challenges and Risks

Despite its strong position, IREDA faces several challenges and risks:

- Regulatory Changes: Changes in government policies and regulations can impact IREDA’s operations.

- Market Competition: Increasing competition in the renewable energy sector poses a challenge for IREDA.

- Technological Advancements: Keeping up with technological advancements is crucial for maintaining competitiveness.

- Financial Risks: Managing financial risks associated with project financing and execution is essential for IREDA’s success.

Mitigation strategies include diversifying the project portfolio, maintaining financial stability, and staying updated with technological advancements.

Factors Contributed to IREDA’s Significant Share Price Increase

Several factors contributed to the significant increase in IREDA’s share price in 2024:

1. Government Policies and Incentives

The Indian government continued to support the renewable energy sector with favorable policies and incentives. This included subsidies, tax benefits, and funding for renewable energy projects, which boosted investor confidence in IREDA.

2. Expansion of Project Portfolio

IREDA significantly expanded its project portfolio by financing new solar, wind, and hydro projects. Notable projects included large-scale solar farms and wind energy installations, which contributed to increased revenue and profitability.

3. Strategic Partnerships and Collaborations

IREDA entered into strategic partnerships and collaborations with key players in the renewable energy sector. For example, the MoU with SJVN and GMR for a 900 MW hydro project in Nepal showcased IREDA’s commitment to expanding its footprint and leveraging synergies with other companies.

4. Strong Financial Performance

The company’s robust financial performance, including significant growth in revenue and net income, played a crucial role. For Q1 FY 2024-25, IREDA reported a 32.11% increase in revenue from operations and a 30.25% increase in profit after tax (PAT) compared to the same period last year.

5. Increased Loan Sanctions and Disbursements

IREDA saw a substantial increase in loan sanctions and disbursements, reflecting its active role in financing renewable energy projects. The loan sanctions for FY 2023-24 were ₹36,840.88 crore, a significant increase from the previous year.

6. Market Demand for Renewable Energy

The growing demand for renewable energy in India and globally contributed to the positive market sentiment. Investors recognized the long-term potential of renewable energy and IREDA’s pivotal role in this sector.

7. Technological Advancements

Advancements in renewable energy technologies, such as more efficient solar panels and wind turbines, made renewable energy projects more viable and attractive. IREDA’s involvement in financing these advanced projects further boosted its market position.

8. Positive Analyst Ratings

Positive ratings and target price predictions from financial analysts also played a role. Analysts highlighted IREDA’s strong fundamentals, growth prospects, and strategic initiatives, which encouraged more investors to buy its shares.

9. Global Renewable Energy Trends

Global trends towards sustainability and renewable energy adoption influenced investor behaviour. As countries worldwide committed to reducing carbon emissions, companies like IREDA, which are at the forefront of renewable energy financing, became more attractive to investors.

Conclusion

In summary, IREDA plays a crucial role in promoting renewable energy in India. Its strong financial performance, strategic initiatives, and market position highlight its importance in the renewable energy sector. While challenges and risks exist, IREDA’s future growth prospects remain promising, driven by supportive government policies, increasing demand for renewable energy, and strategic plans for expansion. As India continues its transition to a sustainable energy mix, IREDA’s contributions will be vital in achieving the country’s renewable energy goals.

Frequently Asked Questions (FAQs)

1. What is IREDA?

Answer: IREDA stands for Indian Renewable Energy Development Agency Ltd. It is a public limited government company established in 1987 under the administrative control of the Ministry of New and Renewable Energy (MNRE). IREDA’s primary mission is to promote, develop, and extend financial assistance for renewable energy and energy efficiency/conservation projects.

2. What types of projects does IREDA finance?

Answer: IREDA finances a wide range of renewable energy projects, including solar, wind, hydro, and biomass projects. It also supports energy efficiency and conservation initiatives.

3. How does IREDA contribute to India’s renewable energy goals?

Answer: IREDA plays a crucial role in financing renewable energy projects, which helps increase India’s renewable energy capacity. By providing financial assistance, IREDA supports the development and implementation of sustainable energy solutions, contributing to India’s energy security and carbon reduction goals.

4. What are some of the major projects financed by IREDA?

Answer: Some notable projects financed by IREDA include large-scale solar farms, wind energy installations, and hydroelectric projects. Recent collaborations include an MoU with SJVN and GMR for a 900 MW hydro project in Nepal.

5. How has IREDA’s financial performance been in recent years?

Answer: IREDA has shown robust financial performance, with consistent growth in revenue and net income. For example, in Q1 FY 2024-25, IREDA reported a 32.11% increase in revenue from operations and a 30.25% increase in profit after tax (PAT) compared to the same period last year.

6. What factors influence IREDA’s stock price?

Answer: Factors influencing IREDA’s stock price include government policies and incentives, market demand for renewable energy, financial performance, strategic partnerships, and global trends towards sustainability.

7. What are the future growth prospects for IREDA?

Answer: The future growth prospects for IREDA are promising, driven by supportive government policies, increasing demand for renewable energy, and strategic plans for expanding its project portfolio. IREDA aims to continue financing innovative and large-scale renewable energy projects.

8. What challenges and risks does IREDA face?

Answer: IREDA faces challenges such as regulatory changes, market competition, technological advancements, and financial risks associated with project financing and execution. Mitigation strategies include diversifying the project portfolio and maintaining financial stability.

9. How does IREDA compare with its competitors?

Answer: IREDA holds a strong position in the renewable energy financing sector. Compared to competitors like Power Finance Corporation (PFC) and Rural Electrification Corporation (REC), IREDA focuses exclusively on renewable energy projects, which gives it a unique advantage in this niche market.

10. How can investors evaluate the long-term potential of IREDA’s stock?

Answer: Investors can evaluate the long-term potential of IREDA’s stock by analyzing its financial performance, growth prospects, market position, and the overall outlook for the renewable energy sector. Positive analyst ratings and target price predictions also provide valuable insights.

-

Microsoft sacks two employees on call for organising vigil for Palestinians killed in Gaza war

IT giant Microsoft sacked two employees on call after they organised an unauthorised vigil at the company’s headquarters for Palestinians killed in Gaza during Israel’s war with Hamas, reported news …

-

IDFC First Bank’s Q2 profit plummets 73%

IDFC First Bank’s profit fell 73% year-on-year to ₹201 crore in the quarter ended September 2024 from ₹751 crore a year earlier, as the bank increasedprovisionsto cover for any future …

-

Shaktikanta Das receives award for A+ grade in Central Bank Report Cards 2024 in USA

Shaktikanta Das, theGovernor of Reserve Bank of India(RBI), on October 26, received award for A+ grade inCentral Bank Report Cards2024, for the second consecutive year.. The award, presented by Global …

-

Don’t Miss Out! How Senior Citizens Can Easily Submit Their Life Certificate Online

Introduction In India, senior citizens who receive pensions are required to submit a life certificate, known as the Jeevan Pramaan certificate, annually to ensure the continued disbursement of their pension. …

-

Can the Second Wife Claim a Deceased Government Employee’s Pension?

Family pension rules can be challenging, especially when it involves the second wife of a deceased government employee. This comprehensive guide aims to provide clarity on this topic, ensuring you …

-

Axis Bank re-appoints Amitabh Chaudhry as MD & CEO of bank for 3 years

Axis Bank on Thursday reappointed Amitabh Chaudhry as the Managing Director and Chief Executive Officer of the bank for the next three years starting January 1, 2025.